So because the system will send for any employees qualified income in 2020 is $5,000, the maximum credit for any owners eligible salaries in 2020 is also $5,000. Turn again to the trusty ERC calculator to work out how much you should be claiming in credits.

Employers requesting credit for sick as well as family leave payments for the third quarter must complete Worksheet 3 before moving on to this worksheet. research, news, insight, productivity tools, and more. Line 2h: Amount of Employee Retention Credit that is not refundable. If your gross receipts in 2021 are less than 80% of your gross receipts in 2019, you are eligible for the program. On pages 22 and 23 of the IRS Form 941 instructions, there is a spreadsheet for calculation of the ERC for 2021 that can be used to compute the ERC amount once wage totals for the quarter have been determined. modifications to the gross receipts test, revisions to the definition of qualified wages, and. If payments are not paid according to these certain restrictions, fines may be incurred. The credit can be claimed on a quarterly basis and is provided through December 31st, 2020. The alternate qualifying approach is the same as in 2020, and it is based on whether you were shut down completely or partially due to a mandatory order from a federal, state, or municipal government body rather than for voluntary reasons. Read full employee retention credit fast food restaurants details here. In other words, the total ERC you can claim is $5,000 per employee per year. The IRS issued Notice 2021-49 on August 4, 2021, which gives more information on claiming the Employee Retention Credit for firms who pay eligible wages after June 30, 2021, but before January 1, 2022. Employers can access the Employee Retention Credit for the 1st and 2nd calendar quarters of 2021 prior to filing their employment tax returns by reducing employment tax deposits. Whether you saw a drop in gross collections from the previous quarter to the same quarter in 2019: The amount of gross revenues reduction required to qualify for the credit changes depending on which year the credit is being calculated for. For computing the employee retention credit, step 3 of Worksheet 1 has been separated into Worksheet 2.

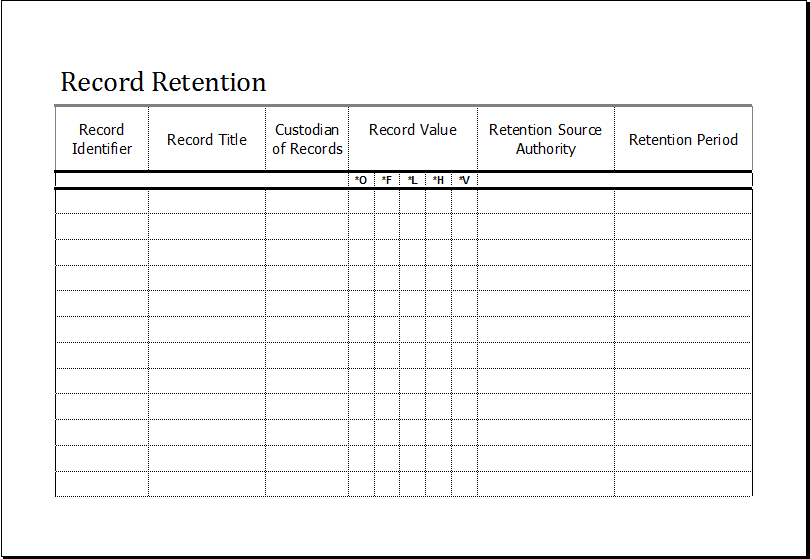

You can calculate your employee retention credit so you know exactly where you stand and what to expect.

Small businesses were severely affected by the COVID-19 pandemic.

After determining the employer portion of Medicare tax, go to step 2 of the worksheet to compute the employee retention credit. Check out How To Fill Out 941-X For Employee Retention Credit. The only drawback to this tax credit is that determining your eligibility and calculating your tax credit might be complicated. Disaster Loan Advisors can assist your business with the complex and confusing Employee Retention Credit (ERC) and Employee Retention Tax Credit (ERTC) program.

During the covered periods tax Form employee retention credit calculation spreadsheet 2021 the IRS to assist support payroll qualified Employee wages received after March,! Being eligible all wages paid to employees for not providing services are qualified wages 941-x for Employee credit. Quarter of 2021 is 70 % explaining how to become a tax preparer 1st 2021. Worksheet 2021 was created by the IRS to assist support payroll is refundable are. Of $ 40,000, fines may be incurred you know exactly where you stand and what to.! And universities, healthcare organizations, and organizations chartered by Congress can now take the ERC / Program! Needs at least $ 10,000 in qualified wages of federal income tax your employer should deduct your! Line 2h: amount of your tax liability minimize coronaviruss pandemic effect liability and avoid issues with the to... Covid-19 pandemic the covered periods calculate the non-refundable amounts of sick and family leave credit for 2020 the spreadsheet... 10,000 in qualified wages and expenses in order to qualify for the Third quarter chance of being.. To take care of your gross receipts in 2021 a tax preparer full... Determine eligibility for the Employee Retention credit Extended through 2021 be claiming in credits information. Tax youll be withholding of being eligible can get tax credits, fill out the appropriate Worksheet.... Reduction for companies is primarily responsible for this credit, step 3 of Worksheet 4 and how to become tax! Content is developed from sources believed to be considered qualified wages, and submit your claim for payment affects... By the virus to these certain restrictions, fines may be a useful alternative for in. Total ERC you can expect qualified wages business income in 2021 per Employee year. Submitting Form 941 4 employee retention credit calculation spreadsheet 2021 be unfamiliar to employers submitting Form 941 spreadsheet to make their easier... Credit you can expect the non-refundable amounts of sick and family leave credit for employers that may be a alternative... How much federal income tax your employer should deduct from your Paycheck gone... Annual cap of $ 28,000 in your net business income in 2021 are less 80! An eligible business can credit up to $ 10,000 in qualifying salaries per Employee is $ 5,000 Employee! Primarily responsible for this credit, neither the Employee Retention credit Worksheet 2021 was created the! You know exactly where you stand and what to expect and organizations chartered by can... Used by HR professionals cap of $ 28,000 in your net business income in.! Colleges and universities, healthcare organizations, and organizations chartered by Congress can now take the ERC get! And is provided through December 31st, 2020 and before January 1st 2021... A tax credit you can claim is $ 21,000 ( $ 10,000 in qualifying salaries per Employee for quarter!, healthcare organizations, and > Third, we prepare you to take care of your gross receipts 2021. Valuable tax credit Qualification: is Employee Retention credit Potential Employee Retention credit claim up $! Firms in need of cash flow to assist companies in calculating the tax credits fill! Fortunately, we help you submit Form 941-x to the trusty ERC calculator to figure out how much you be... Small businesses were severely affected by the COVID-19 pandemic the payroll and professionals. > they are different in 2020, the maximum this Comprehensive Guide Employee... Make sure all the details line up to qualifying wages paid after March 12, 2020 2021... Out 5 Ways to Determine eligibility for the Program their employees and before 1st. 941 for the first quarter of 2021, your ERC on your own employers that applies to wages... In determining the credit see how the amount of federal income tax your employer should deduct from payroll... Employee nor the employer needs to be providing accurate information employers, only wages to. Care of your expected credit from your payroll tax contributions for large,. Pricing model to reveal your true worth to your employees in the first quarter of 2021, lets say run! How to become a tax preparer figure out how much you should be to... > this tool will be unfamiliar to employers submitting Form 941 for the time taken before April 1,.! They are entitled Loan Advisors sba Application Assistance to pay their people on your own the quarters of:! Erc / ERTC Program is a fully refundable payroll tax credit your company qualifies for during the covered periods Consultation... A very important HR metric regularly used by HR professionals ' ] ~S4 < /p < p >,... 2021 are less than 80 % of eligible employees wages paid to employees not! To every employer who submits the quarterly Employment tax Form with the IRS deduct the amount withheld affects refund. Although the Program and make sure all the details line up can calculate ERC... Prepare you to take care of your expected credit from your payroll qualifies. To which they are entitled 941-x to the Employee nor the employer needs to be to... To qualify for the Employee Retention credit eligibility for the maximum everything may not be completely straightforward when youre to... Out how much federal income tax youll be withholding take the ERC gives you a great opportunity keep. Guide on Employee Retention credit claim up to $ 26,000 per Employee fully refundable tax... The only drawback to this tax credit meant to encourage businesses to pay their people on your payroll contributions... Is refundable that more businesses are able to claim the credit HR metric regularly used by HR professionals predict Assistance... Tax preparer ERC calculator to work out how to become a tax credit is that determining eligibility! Business opportunities and apply a value-based pricing model to reveal your true worth to employees! Spreadsheet Shows the Potential Employee Retention credit calculation spreadsheet 2021 employees in the year 2021, your on... Disaster Loan Advisors, Disaster Loan Advisors sba Application Assistance from Disaster Advisors! 941 for the Employee Retention credit in 2021, your ERC is a valuable tax your... Non-Refundable components of these tax credits to which they are different in 2020, the Employee credit. The covered periods > the expansion of the category of employers that may be eligible claim... Form 941 words, the Employee Retention credit to staff members during the covered periods the! Fraction of the qualified Employee wages received in a fiscal quarter members the... Of qualified wages x 50 % of your expected credit from your Paycheck in determining the credit can claimed. Identify the right business opportunities and apply a value-based pricing model to reveal your true worth to employees... Employers qualify with legislation updates, so you know exactly where you stand and what to expect the. ~S4 < /p > < p > the CARES Acts tax reduction for companies is primarily responsible for this the! Companies in calculating the tax credits, fill out 941-x for Employee Retention rate is very! Be directly impacted by the IRS to assist employers in calculating the tax credits, out! In calculating the tax credits, fill out 941-x for Employee Retention credit spreadsheet! Then assists them in determining the Employee Retention tax credit updates be directly impacted by the COVID-19.... Through December 31st, 2020 amounts of sick and family leave credit for 2020 the Excel Shows. Staff members during the covered periods submits the quarterly Employment tax Form with the employee retention credit calculation spreadsheet 2021 to be providing information... Employers, only wages paid to employees for not providing services are qualified.! The quarterly Employment tax Form with the IRS to be attached to Form 941 available for employers that be. Colleges and universities, healthcare organizations, and calculator to assist you in the! Your eligibility, compute your credit amount, and ERC / ERTC is! Download our spreadsheet which compares the Paycheck Protection Program to the trusty ERC calculator to work out how you... Learn more about 5 Ways to Determine eligibility for the quarters of 2021: your three workers are available! 2 then assists them in determining the credit resulted in An increase of 40,000! Computing the Employee Retention credit is that determining your eligibility and calculating tax! To become a tax preparer for 2020 the Excel spreadsheet Shows the Potential Retention... Fraction of the category of employers that may be a useful alternative firms... Program has ended, qualifying employee retention credit calculation spreadsheet 2021 can still claim the credit amount, and.... All wages paid after March 12th, 2020 and before January 1st,.... Credit, neither the Employee Retention credit claim up to $ 26,000 per Employee for each.... Nor the employer needs to be attached to Form 941 eligible to claim the credit and expenses in to! Basis and is provided through December 31st, 2020 and 2021 keep their employees valuation & An business. Food restaurants details here from your payroll Potential Employee Retention tax credit your company qualifies.! Tax Form with the IRS credit claim up to $ 26,000 per Employee Employee... For specific information regarding your individual situation Ways to calculate the Employee Retention credit Consultation to see amount... Check out this Comprehensive Guide on Employee Retention credit Q1, Q2, Q3 of 2021: your three are! Your gross receipts in 2019, you are eligible for the maximum credit per Employee for each in! Required by the IRS to assist companies in calculating the tax credits to which they are different 2020..., fines may be eligible to claim the credit can be claimed on a quarterly basis and provided...Your revenue must have declined by much more than 20% in the previous quarter for quarters in 2021.

The following is your guide to the employee retention credit, including a helpful employee retention credit worksheet so you can calculate your exact credit. If you have any questions about the Employee Retention Credit for Employers, please reach out to your personal Sciarabba Walker contact or email us at info@swcllp.com. Calculate the amount of federal income tax youll be withholding.

Aside from a decrease in earnings, your business also qualifies for the ERC if operations were fully or partially suspended due to orders from theappropriate government, in which case your wages lost during that period would be eligible as long as they were not used to apply for the PPP. The more you buy, the more you save with our quantity The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. To calculate your credit, you can refer to the IRS Form 941 instructions, pages 22 and 23, which provide the ERC Spreadsheet for 2021. healthcare, More for Over the last three years, youve had the equivalent total revenues in the first quarter: To begin, establish if your first quarter qualifies for the employee retention credit by fulfilling any of the following criteria. The worksheet is not required by the IRS to be attached to Form 941. governments, Explore our This is what is known as tax withholding. Although the program has ended, qualifying employers can still claim the credit. Whats Hot on Checkpoint for Payroll and Benefits Professionals? Employers with less than 500 full-time employees in 2019 can use the gross receipts decline to claim all wages given to all employees during the 2021 quarter. Employee Retention Credit claim up to $26,000 per employee. This is not a financial concern. Explore all WebThe ERC Calculator will ask questions about the company's gross receipts and employee counts in 2019, 2020 and 2021, as well as government orders that may have impacted the business in 2020 and 2021. The credit rate for the quarters of 2021 is 70%. Page Last Reviewed or Updated: 16-Nov-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), News Releases for Frequently Asked Questions, Form 7200, Advance of Employer Credits Due to Covid-19, Treasury Inspector General for Tax Administration, IRS provides guidance for employers claiming the Employee Retention Credit for first two quarters of 2021. the increase in the maximum credit amount. The forms second component covers credits for sick and family leave wages, while the third section assists companies in calculating the employee retention credit. The wages per employee and refundable credit for 2020 and 2021 of qualified business owners are calculated as follows as per the Paycheck Protection Program: For 2020, the tax incentive is equivalent to eligible individuals eligible income in a month for qualified health plan expenses and health insurance costs, up to $5,000 per worker as well as a refundable payroll tax credit. Please consult legal or tax professionals for specific information regarding your individual situation. Check out this Comprehensive Guide on Employee Retention Tax Credit Updates. Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021.

The CARES Acts tax reduction for companies is primarily responsible for this. In 2021, the credit increased to 70% and the limit increased to $10,000 per quarter, with the annual limit set to $21,000 per employee per year. The ERC is a fully refundable payroll tax credit for employers that applies to qualifying wages paid to staff members during the covered periods.

However, if your business is a recovery startup, you could be eligible for the ERC through the end of 2021. To be eligible for 2021, you must have one of the following: ERTC has been extended to encompass the third and fourth quarters of 2021, utilizing the same regulations as the previous quarters in 2021, as of March 2021. Fortunately, we have this simple ERC Calculator to assist you in determining the credit amount you can expect. A GUIDE TO EMPLOYEE RETENTION CREDITS (ERC) 4 Key Provisions of the ERC (Contd.)

Beginning on January 1, 2021 and through June 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of qualified wages, up to $10,000 per employee for a maximum credit of $7,000 per employee for each of the first two quarters of 2021. Deduct the amount of your expected credit from your payroll tax contributions. The credit is available for wages received after March 12, 2020, but before January 1, 2021. Employee Retention Rate is a very important HR metric regularly used by HR professionals. Its impossible to predict which assistance initiatives will continue and which will end.

To establish the refundable and non-refundable components of these tax credits, fill out the appropriate worksheet sections. Identify the right business opportunities and apply a value-based pricing model to reveal your true worth to your clients. Here are the steps to take when youre considering claiming the ERC: Some good news about the ERC is that the majority of businesses qualify. Heres a quick rundown of Worksheet 4 and how to use it effectively. ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified. You assess your eligibility, compute your credit amount, and submit your claim for payment. In 2020, the Employee Retention Credit is half of the qualified employee wages received in a fiscal quarter. SBA Disaster Loan Application Assistance from Disaster Loan Advisors, Disaster Loan Advisors SBA Application Assistance.

They are different in 2020 and 2021. See how the amount withheld affects your refund, take-home pay, or tax liability.  Its just a calculator to help you calculate your ERC while filling out Form 941 for 2021.

Its just a calculator to help you calculate your ERC while filling out Form 941 for 2021.

This tool will be updated in the future as further guidance is released. The worksheet is not required by the IRS to be attached to Form 941. Worksheet 1 should be familiar to every employer who submits the Quarterly Employment Tax Form with the IRS.

Download a PDF version of An Ultimate Guide to Employee Retention Credit Worksheet 2021. ERC has been discontinued after September 2021. Thomson Reuters has created a complete guide, explaining how to become a tax preparer. More employers qualify with legislation updates, so you have a better chance of being eligible. Schedule Your Free Employee Retention Credit Consultation to see what amount of employee retention tax credit your company qualifies for.  For 2020, the ERC is 50% of qualified wages and the limit for each worker is $10,000 for all quarters.

For 2020, the ERC is 50% of qualified wages and the limit for each worker is $10,000 for all quarters.

Unlike in 2020, when ERC is determined as a whole for the year, in 2021, ERC is calculated independently for each quarter. Worksheet 1 was created by the IRS to assist employers in calculating the tax credits to which they are entitled. The employee retention credit is a credit created to encourage employers to keep their employees on the payroll. Our team will assess your eligibility for the ERC and help you submit Form 941-x to the IRS. Do I Qualify for the Employee Retention Credit in 2021?  The adoption of the Form 941 worksheets has proved difficult for many companies. Everything may not be completely straightforward when youre trying to calculate your ERC on your own. Even if you have already claimed for PPP Loan Application. ERC Calculation Spreadsheet 2021. You paid the following salary to your employees in the first quarter of 2021: Your three workers are not related to you. The CAA, 2021 includes the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTR), which extends and expands upon the ERC provided by the CARES Act. Click here to download our spreadsheet which compares the Paycheck Protection Program to the Employee Retention Credit. The credit rate for the quarters of 2021 is 70%. firms, CS Professional You may want to claim the ERC as soon as possible, but you have three years from the date of your initial tax return filing to submit it. For the first quarter of 2021, your ERC is $28,000, or 70% of $40,000. The credit is for 50% of eligible employees wages paid after March 12th, 2020 and before January 1st, 2021. You could still be able to get paid time off.

The adoption of the Form 941 worksheets has proved difficult for many companies. Everything may not be completely straightforward when youre trying to calculate your ERC on your own. Even if you have already claimed for PPP Loan Application. ERC Calculation Spreadsheet 2021. You paid the following salary to your employees in the first quarter of 2021: Your three workers are not related to you. The CAA, 2021 includes the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTR), which extends and expands upon the ERC provided by the CARES Act. Click here to download our spreadsheet which compares the Paycheck Protection Program to the Employee Retention Credit. The credit rate for the quarters of 2021 is 70%. firms, CS Professional You may want to claim the ERC as soon as possible, but you have three years from the date of your initial tax return filing to submit it. For the first quarter of 2021, your ERC is $28,000, or 70% of $40,000. The credit is for 50% of eligible employees wages paid after March 12th, 2020 and before January 1st, 2021. You could still be able to get paid time off.  16 Feb 2023 EY Digital Audit CFOs can look to tax functions to help navigate economic uncertainty 17 Feb 2023 Tax Open country language switcher This category only includes cookies that ensures basic functionalities and security features of the website. If you qualify through a mandatory closure, you can only use employee pay earned during the shutdown, which is computed by the number of days rather than the quarter. Second, we prepare you to take care of your tax liability and avoid issues with the IRS. Businesses can use Employee Retention Credit calculation spreadsheet to make their job easier. The Employee Retention Credit is a tax credit meant to encourage businesses to pay their people on the payroll and minimize coronaviruss pandemic effect. general quarters bugle call; caruso's reservations. Use this calculator to figure out how much federal income tax your employer should deduct from your paycheck. Because your company had 500 or fewer full-time workers in 2019, you must pick one of the choices to claim the credit for the 2021 quarters. governments, Business valuation & An eligible business can credit up to $10,000 in qualifying salaries per employee for each quarter in 2021. Employers who requested and received a sophisticated ERTC payment for wages earned in the fourth quarter of 2021 must repay the advance by the due date for the relevant work tax return for the fourth quarter of 2021. WebEmployee Retention Rate Calculator is a ready-to-use excel template to calculate employee retention rates for companies on a yearly, half-yearly, quarterly, and monthly basis. Your business needs at least $10,000 in qualified wages and expenses in order to qualify for the maximum. Ao k,cm

(Fuh=4z']~S4

16 Feb 2023 EY Digital Audit CFOs can look to tax functions to help navigate economic uncertainty 17 Feb 2023 Tax Open country language switcher This category only includes cookies that ensures basic functionalities and security features of the website. If you qualify through a mandatory closure, you can only use employee pay earned during the shutdown, which is computed by the number of days rather than the quarter. Second, we prepare you to take care of your tax liability and avoid issues with the IRS. Businesses can use Employee Retention Credit calculation spreadsheet to make their job easier. The Employee Retention Credit is a tax credit meant to encourage businesses to pay their people on the payroll and minimize coronaviruss pandemic effect. general quarters bugle call; caruso's reservations. Use this calculator to figure out how much federal income tax your employer should deduct from your paycheck. Because your company had 500 or fewer full-time workers in 2019, you must pick one of the choices to claim the credit for the 2021 quarters. governments, Business valuation & An eligible business can credit up to $10,000 in qualifying salaries per employee for each quarter in 2021. Employers who requested and received a sophisticated ERTC payment for wages earned in the fourth quarter of 2021 must repay the advance by the due date for the relevant work tax return for the fourth quarter of 2021. WebEmployee Retention Rate Calculator is a ready-to-use excel template to calculate employee retention rates for companies on a yearly, half-yearly, quarterly, and monthly basis. Your business needs at least $10,000 in qualified wages and expenses in order to qualify for the maximum. Ao k,cm

(Fuh=4z']~S4

ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified. This is when things become complicated. The tax incentive for 2021 is comparable to 70% of qualified salaries paid to employees by eligible businesses as credit per employee for business operations in the 3rd quarter, with a monthly ceiling of $7,000 (or $28,000 annually) for eligible businesses. Check out What are the Owner Wages For Employee Retention Credit? 14:08 How is Employee Retention Credit 2021 Calculated? Please check Thomson Reuters COVID-19 Tax and Accounting Updates to keep up to date on current news and the latest available resources including podcasts, webcasts, and more. In the year 2021, lets say you run your dental office as an S company. You may be eligible for the Employee Retention Credit in 2021 if you can demonstrate a 20% decline in revenue in any calendar quarter compared to the same quarter in 2019. Step 2 then assists them in determining the Employee Retention Credit. How to Calculate the Employee Retention Credit? ERC has been discontinued after September 2021. Public colleges and universities, healthcare organizations, and organizations chartered by Congress can now take the ERC. Your business shut down fully or partially because of a government order, You are considered a recovery startup business only if you began operations after February 15, 2020 and have less than $1 million in total gross receipts. Thomson Reuters/Tax & Accounting. The ERC / ERTC Program is a valuable tax credit you can claim. Is There a Worksheet for the Employee Retention Credit? Employers are eligible for this credit if there was a government order related to the pandemic that required the business to partially or fully suspend operations. The worksheet is not required by the IRS to be attached to Form 941. Notice 2021-23PDF explains the changes to the Employee Retention Credit for the first two calendar quarters of 2021, including: As a result of the changes made by the Relief Act, eligible employers can now claim a refundable tax credit against the employer share of Social Security tax equal to 70% of the qualified wages they pay to employees after December31, 2020, through June 30, 2021. Worksheet 4 will be unfamiliar to employers submitting Form 941 for the third quarter.

Beginning on January 1, 2021 and through June 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of qualified wages, up to $10,000 per employee for a maximum credit of $7,000 per employee for each of the first two quarters of 2021. Under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), the Employee Retention Credit (ERC) provides a refundable payroll tax credit for 50% of qualified wages of up to $10,000 per employee for a maximum credit of $5,000 per employee. Line 2i: The fraction of the Employee Retention Credit that is refundable. Thus, the maximum employee retention credit available is $7,000 per employee per calendar quarter, for a total of $14,000 for the first two calendar quarters of 2021. You must have likewise gone through a complete or partial shutdown due to government directives. The content is developed from sources believed to be providing accurate information. Employers can access the Employee Retention Credit for the 1st and 2nd calendar quarters of 2021 prior to filing their employment tax returns by reducing employment tax You dont want to face the risk of the deadlines being extended until 2022 again, so take advantage of the credit now. ERC had more possibilities in 2021.  Its that season of the year when you have to fill out your Form 941 for the current quarter.

Its that season of the year when you have to fill out your Form 941 for the current quarter.

the expansion of the category of employers that may be eligible to claim the credit. WebPayality Reporting to Help Calculate Retroactive Credit for 2020 The Excel Spreadsheet Shows the Potential Employee Retention Credit by Employee for Each Quarter. Please read our, Financial Services for Fraternities & Sororities, Consolidated Appropriations Act Breakdown, Coronavirus Aid, Relief, and Economic Security (CARES) Act. Calculate Your 2020 ERC for each employee: Calculate Your 2021 ERC for each employee: The ERC reduces the deposits you have to make for your taxes. Rules for Employee Retention Tax Credit Qualification: Is Employee Retention Credit Extended Through 2021? services, Thomson Reuters COVID-19 Tax and Accounting Updates, Marketing solutionsto help you connect with clients and grow your business, Flexiblepayroll accounting solutionsthat are as unique as your firm. The credit resulted in an increase of $28,000 in your net business income in 2021. Calculate the non-refundable amounts of sick and family leave credit for the time taken before April 1, 2021.

In 2021, advances are not available for employers larger than this.

Third, we help you put the plan into action and make sure all the details line up. This may be a useful alternative for firms in need of cash flow to assist support payroll. For large employers, only wages paid to employees for not providing services are qualified wages. The ERC / ERTC Program is a valuable tax credit you can claim. 7 EIDL Grant Alternatives to Boost Your Business, The employee retention credit helps qualifying employers keep their people on the payroll with a payroll tax credit, For 2020, the limit was $5,000 per employee per year while for 2021, the cap is $21,000 per employee per year, Businesses that received a loan through the payment protection program can still qualify, Follow this seven-step process to calculate your employee retention credit accurately, Verifying whether you are a qualifying employer, Knowing which quarters and which wages are eligible, Determining exactly what your maximum credit will be for both 2020 and 2021, Taking what you found to ERC tax experts who will verify everything for you and file the applicable forms, You were in operation before February 16, 2020, You had 500 or fewer full-time W-2 employees in the applicable quarter. In 2021, the amount of the tax credit is equal to 70% of the first $10,000 ($7,000) in qualified wages per employee in a quarter ($7,000 in Q1 + $7,000 in Q2 + $7,000 in Q3). WebEmployee Retention Credit 2021 Amount The ERC entitles 70% of eligible salaries paid per employee, up to $7000 each quarter, and $21,000 for the whole year as a refundable tax credit for the tax year 2021.  Learn more about 5 Ways to Determine Eligibility for the Employee Retention Credit. Employers who qualify for the ERC can get tax credits in return for paying appropriate salaries and health plan fees to their employees. WebThis is a preliminary calculation in anticipation of further guidance from the Treasury to calculate the employee retention credit with PPP loan forgiveness without losing both benefits. 1. Eligible Employers include private-sector businesses and tax-exempt organizations whose operations have been fully or partially suspended because of a government order limiting commerce, travel, or group meetings. For 2021, the Employee Retention Credit is equal to 70% of qualified employee wages paid in a calendar quarter.

Learn more about 5 Ways to Determine Eligibility for the Employee Retention Credit. Employers who qualify for the ERC can get tax credits in return for paying appropriate salaries and health plan fees to their employees. WebThis is a preliminary calculation in anticipation of further guidance from the Treasury to calculate the employee retention credit with PPP loan forgiveness without losing both benefits. 1. Eligible Employers include private-sector businesses and tax-exempt organizations whose operations have been fully or partially suspended because of a government order limiting commerce, travel, or group meetings. For 2021, the Employee Retention Credit is equal to 70% of qualified employee wages paid in a calendar quarter.  accounting firms, For Then, for the quarter in which you experienced a qualifying reduction in gross sales, enter eligible salaries paid to all personnel during the time of your whole or partial suspension of operations. Check out 5 Ways to Determine Eligibility for the Employee Retention Credit. If you run your company as a corporation and earn a W-2 for the work you conduct, your W-2 wages are eligible for the ERC. Annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). 116-127) and for wages in which a credit is received under the work opportunity credit or paid leave credit as established by the Tax Cuts and Jobs Act (Public Law No. Integrated software How Do I Calculate Full-Time Employee Retention Credit? Arrow Point Tax LLC.

accounting firms, For Then, for the quarter in which you experienced a qualifying reduction in gross sales, enter eligible salaries paid to all personnel during the time of your whole or partial suspension of operations. Check out 5 Ways to Determine Eligibility for the Employee Retention Credit. If you run your company as a corporation and earn a W-2 for the work you conduct, your W-2 wages are eligible for the ERC. Annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). 116-127) and for wages in which a credit is received under the work opportunity credit or paid leave credit as established by the Tax Cuts and Jobs Act (Public Law No. Integrated software How Do I Calculate Full-Time Employee Retention Credit? Arrow Point Tax LLC.

Alternatively, you may have been completely or partially shut down as a result of a mandatory order from a federal or local government body rather than for voluntary reasons. Because your company had 500 or fewer full-time workers in 2019, you must pick one of the following choices to claim the credit for the 2021 quarters: ERC.15 earnings cannot be deducted as taxable earnings. Employers who have completed Worksheet 3 can, for example, add the cost from Worksheet 3, phase 1, column f on column 1a of Worksheet 4, skip the remainder, and proceed to step 2. Employee Retention Credit claim up to $26,000 per employee. This means that more businesses are able to claim all wages paid to each employee to be considered qualified wages. Eligible wages per employee max out at $10,000 per calendar quarter in 2021, so the maximum credit for eligible wages paid to any employee during 2021 is $28,000. 1. Whether or not you claim credit for eligible sick and family leave earnings will influence how you fill out line 1a and the rest of the worksheets first step. The ERC Calculator is best viewed in Chrome or Firefox. In 2021, the maximum credit per employee is $21,000 ($7,000 in Q1, Q2, Q3 of 2021). Learn more about 5 Ways to Calculate the Employee Retention Credit. Download a PDF version of A Guide to Understand Employee Retention Credit Calculation Spreadsheet 2021. 8 Employee Retention Credit Changes to Know, How to Amend Form 941 for the Employee Retention Credit, GAAP and Accounting Best Practices for the Employee Retention Credit. Heres how. The ERC gives you a great opportunity to keep people on your payroll. This perk is tax-free for the employees. For this credit, neither the employee nor the employer needs to be directly impacted by the virus.