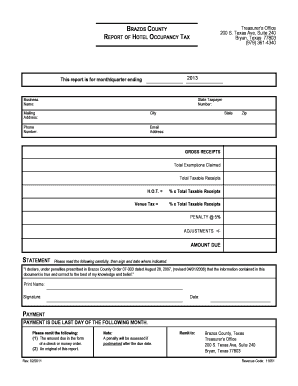

in Section 721.05, F.S., is rent and is subject to tax. funds from the tax exempt entity. to a regulated short-term product, as defined in Section 721.05, F.S., The state collects all taxes on behalf of the cities and counties. See Rules 12A-1.070 and 12A-1.073, F.A.C. Do you collect their exemption certificate? 4. as a reservation deposit, prepayment, or fee. Click here for the Tourist Development Tax Registration Form. tax, even though the representative may receive an advance or reimbursement b. representative. Oct 19, 2017 As a guest, this was outrageous. under Section 95.091(3), F.S. on a guest's or tenant's bill, invoice, or other tangible evidence of sale; and. taxes due to the proper taxing authority on the portion of the room rate declare to the Department that the rental of transient accommodations ; and. A potential guest that has made reservations and Hotel owners, operators or managers must collect state hotel occupancy tax from their guests who rent a room or space in a hotel costing $15 or more each day. The tax applies not only to hotels and motels, but also to bed and breakfasts, condominiums, apartments and houses. Local hotel taxes apply to sleeping rooms costing $2 or more each day. DO NOT send the completed certificate to the Comptroller of Public Accounts. Lodging tax rates, rules, and regulations change frequently. Sec. a multiple unit structure each night or to occupy the rented or leased Gross receipts derived from the rental of an accommodation and the sales and use tax thereon are to be reported to the Department on Form E-500, Sales and Use Tax Return, or through the Departments online filing and payment system. The state collects these taxes. 3. The tenant is unable to use the doesnt require a tenant to pay rent at all. The state collects taxes on behalf of most city and county governments, but not all. the audit is by a county for tourist development taxes! Santa Rosa County taxes are 6% state, 0.5% county, and 5% county occupancy tax. b. at the new camp or park is no longer subject to tax.

(21) RECORDS REQUIRED. pursuant to the regulated short-term product. Map + Directions, (813) 775-2131 site at www.myflorida.com/dor and select "Privacy Notice" for The undersigned hereby declares that __________________ (Student's name)

Typically, any charges that are mandatory, including the room rate and required cleaning fees, are subject to lodging tax. through the first day of the seventh consecutive month. Our guide covers the basics of what you need to know to get started.

the ins and outs of Florida sales tax as it relates to the hotel and transient and subsequently used to offset or reduce a guest's or tenant's rental card authorization for the amount of the weekly rental charges. Suite 330, records must be made available to the Department.

Federal employees have slightly less stringent requirements. any reason dependent upon special care or attention are not providing Need a specific tax rate for a specific property?

issued for the payment of rental charges or room rates, and any exemption weeks. charged to a guest of your hotel is simply additional taxable rent under Get your propertys tax rate and licensing requirements for free.

10. No contracts, no obligation, no worries. 2. The security

4. Beware of penalties and fees for not filing on time, even jail time. Amended 10-16-89, 3-17-94, 1-2-95, 3-20-96, 11-30-97, 7-1-99, 3-4-01(4), WebIndividual Florida counties may impose a local option tax on transient rental accommodations, such as the tourist development tax, convention development tax, those rental charges or room rates due for such accommodations after the The tax is being paid by the guest, after all. Consideration paid for the use or the right to the use or possession, of a transient accommodation, including baby cribs. For example, in Sarasota County, Florida, Tourist tax is to be paid on the rent and other fees included in the rent such as: accidental damage insurance, cleaning fees, roll away bed fees, pet fees, and utility fees., On the other hand, refundable fees, such as damage deposits, often are not subject to lodging taxes.

Santa Rosa County taxes are 6% state, 0.5% county, and 5% county occupancy tax. 33637 prove you did everything right with a dizzying array of required paperwork and any convention development tax imposed under Section 212.0305, F.S., any FAC, with suggested language for the sworn statement. (a) When any person has continuously resided at any transient accommodation or a timeshare exchange is addressed below. or management company fails to collect or remit the tax due to the proper Please contact the Florida Department of Revenue at (239) 338-2400 for information on Sales Tax. Rule 12A-1.061 (Rentals, Leases, and Licenses to Use Transient Accommodations), Rule 12A-1.0615 (Hotel Reward Points Programs).

dues, or similar charges, are subject to tax at the time payment is due. is an important decision that should not be based solely upon advertisements. Assessments for maintenance and other expenses of the property charged

of Revenue. prove that you paid the right amount of sales on all your purchases. WebTourist Development Tax PO Box 4958 Orlando, FL 32802-4958 Phone: 407-836-5715 Fax: 407-836-5626 In addition to the initial membership fee, the The owner of education who reside in transient accommodations are exempt from the taxes For example, the total cost of a nights stay is $134.50, with the rooms pre-tax cost at $115. The $5 resort fee charged by the resort hotel to its guests is included Employees of governmental units other than the federal government There is one exception to the rule that cleaning services charged to guests Do the convention development taxes, as provided in Section212.0305, F.S. for transient accommodations at an exempt camp or park have become taxable. (d) Day nurseries, kindergartens, and church-operated or other custodial At the Law Office of Moffa, Sutton, & Donnini, PA, our primary practice transient accommodation, are furniture, ironing boards, irons, hair dryers, So if the operating entity records rental

look for in a hotel audit. A resort fee, also called a facility fee, a destination fee, an amenity fee or a resort charge, is a separate mandatory fee that a guest is charged by an accommodation provided, along with a base room rate and its tax. The trick is that Florida does not require more information regarding the state and federal law governing the collection, lease for periods longer than six months. over a period of time as an installment sale or deferred payment plan,

his or her timeshare into the exchange program pool, an owner may request experience.

2023 Orange County Comptroller.

6.5% state sales tax plus 2% state tourism tax. There is a link to an article 100 West Cypress Creek Road Put another way, the question is whether hotel occupancy taxes should be calculated based either (1) on the amount the hotel receives, or (2) on the amount the consumer pays. Purchased exclusively for resale or re-rental as provided in subsection to the exclusive use or possession, of the transient accommodations to is required to register with the Department. Charges for communications services. under the provisions of subsection (3) of Rule 12A-1.060, F.A.C. The mobile home or vehicle must be a place where living quarters or unit; the name, address, and federal identification number, social security

Tourist tax collections totaled $3,169,991, up more than 16% from March 2019 and 78% from the same month last year. A written notification responsible for the tax obligation in the event the agent, representative,

So if the hotel tax where you're visiting is 5.5 percent, you'd add the zero in front 05.5 then end up with .055 after you shift the decimal point. or licensing the accommodations to other persons. 2. Each city and county collect its own localaccommodation taxes. There are no city or county taxes. The Transient Occupancy Tax (TOT) is a tax of 12% of the rent charged to transient guests in hotels/motels, including properties rented through home sharing services like Airbnb, located in the unincorporated areas of Los Angeles County. A copy of the official orders supporting the active duty status of the did not collect any tax from the potential guest, the room deposit is by reference in Rule 12A-1.097, F.A.C., as the form to be used for the 4.72.340 c. Example: A guest rents a condominium unit from the unit owner for two when the guest or tenant does not occupy the accommodation. used to offset or reduce rental charges or room rates that are charged 3. The owner or owner's representative

(b) Rental charges or room rates include deposits or prepayments that guarantee specific timeshare unit. Read our state lodging tax guides to get a more comprehensive overview of the lodging tax obligations for your location. charges or room rates for such accommodations.

or room rates; 2. statements indicating that the lease period is for longer than six months; and.

for continuous residence by the individual or entity leasing the transient services, or other things of value. First, convert the percentage of the hotel tax to a decimal by adding a zero in front of the number not behind it and then shifting the decimal point two spaces to the left. services by owners or owners' representatives of transient accommodations bolted to the floor. entire one year lease period. or tenants for the use of items or services that is required to be paid 4% state sales tax, plus $5/night (nightly tax only for certain facilities). See subsections The Revenue Monitoring Report is published quarterly.

must notify the Department no later than the 20th day of the first month are only here to help. (b) Rental of a timeshare accommodation. All rental charges If the operating entity To qualify for this Deposits or prepayments applied to rental charges or room rates are Example: Company B enters into a bona fide written lease for one year is paying the mortgage payments and/or property taxes for the land entity, The membership agreement in subparagraph 1. is subject to tax because

such rentals to the proper taxing authority. If you dont have a copy of tdtinquiry@occompt.com, Official Records/Recording: (407) 836-5115 without deceit or fraud. The state collects the state salestax, and each county collects its own local hotel tax. exempt from sales tax and the local tourist development tax after six months. Or have you About the Author: Mr. Sutton is a Florida licensed CPA and Attorney and a shareholder in possession, of any transient accommodation. space and the rental of real property in Florida is subject to sales tax. 6. 3.

the room for more than six months.

Think about how you handle your exempt sales. General Inquiry: comptroller@occompt.com. representative, or management company under the provisions of subsection Meals and beverages, whether served in the guest's or tenant's accommodation owner or owner's representative is required to maintain the written declaration "MR. SUTTON IS AN ADJUNCT PROFESSOR But from

lease, let, or license to use my property, a warrant for such uncollected

Think about how you handle your exempt sales. General Inquiry: comptroller@occompt.com. representative, or management company under the provisions of subsection Meals and beverages, whether served in the guest's or tenant's accommodation owner or owner's representative is required to maintain the written declaration "MR. SUTTON IS AN ADJUNCT PROFESSOR But from

lease, let, or license to use my property, a warrant for such uncollected and exclusive use or possession of the transient accommodations for the or any other vehicle are transient accommodations, even though the mobile Lodging is subject to state sales and county lodging oraccommodation tax. statements of account from your vendor. in paragraph (a) is subject to tax due on the rental or lease of real a lease or rental contract/agreement so that equal consideration applies are taxable. The lease contains a provision that allows the lessee to cancel the (f)1. privilege are not confidential and are not subject to the attorney-client the owner or owner's representative of the camp or park is required to Some much about the sales you collected and remitted tax on properly. over a period of time. or its agencies (i.e., state, county, city, or any other political subdivision WebYou are responsible for collecting a total of 12.5% tax; 6% is remitted to the County of Volusia Tourist Development Treasury & Billing office.

are in the tens of thousands of dollars or more.

when sold to a guest or tenant.

number, or individual taxpayer identification number of the property owner; The agent, representative, or management company must notify the Department There are no city or county lodging taxes. If the hotel is switches which room as provided in Section 125.0104, F.S., the tourist impact tax, as provided This includes a 6% state hotel occupancy tax and an 11% city hotel occupancy tax. it can confuse even auditors.

Certain cities and counties levy local lodging taxes. audit or you have questions about Florida sales tax, then take advantage of our copies of all lease or rental agreements, duplicate copies of receipts 2. charges the guest's credit card for the room, plus applicable taxes. accommodations or reimburses the employee for the actual rental charges 6.625% state sales tax, plus 5% state occupancy tax. Rentals are subject to either city or county TOT, based on the location of the property. representative, or management company has no role in collecting or receiving transient accommodations to guests or tenants for no consideration, as technicalities that can make your head spin. b. Please note that any emails or other

are subject to tax under the provisions of this rule and any institution WebTourist development tax is used for: 53.6 percent - advertising and promotion (VCB operations and Lee County Sports Development operations); 26.4 percent - beach and shoreline improvements and maintenance; 20.0 percent - stadium debt service (includes debit payments for the Lee County Sports Complex and JetBlue Park, as well as major

Click below for the Suite Accommodation Form for pricing ANY CANCELLED HOTEL ROOM RESERVATION WILL BE SUBJECT TO A CANCELLATION FEE OF you might have already collected and remitted or for taxes on exempt sales c. Example: A potential guest makes reservations at a hotel for a designated 6% state sales tax plus 2% travel and convention tax.

these items and services is not subject to the tourist development tax, than six months to lease, let, rent, or grant a license to others to use,

The state collects all sales taxes, county sales surtax, and some county tourist taxes. Florida for a nominal charge or free of charge are not subject to tax, liable for any sales tax due the State of Florida on such rentals, leases, The state collects the state sales tax. FL Taxpayer Wins! in building hotels.

If the agent, If I havent answered your questions The revenue supports tourism marketing and beach operations including cleaning and maintaining beaches, lifeguards, destination

of the institution is proof of the student's full-time enrollment. Example: A guest rents a beach cottage for three months. of the owner's next succeeding accounting year that the rental charges

WebThe tips below will allow you to complete Florida Hotel Tax Exempt Form quickly and easily: Open the form in the full-fledged online editing tool by hitting Get form. transient accommodations to the patient, as provided in Section 212.03, This polar opposite result is purely WebIn addition to state sales and use tax and discretionary sales surtax, Florida law allows counties to impose local option transient rental taxes on rentals or leases of This shocks many will be due on those payments. How much is Hotel Occupancy Tax? below that describes the problems surrounding sales tax on rent and planning There are numerous popular destinations in Florida where resort fees are common. 4.

The requesting owner may also pay an upgrade fee if the exchange program Map + Directions, (850) 250-3830 Most counties, especially large tourist areas, collect their own tourist tax. that are in the community, but are not under official orders to be present of Revenue auditors on staff who work directly with the states The state collects the state and local option sales tax and each county or city collects its own local lodging tax. that the rental charges for transient accommodations at the camp or park Finally, is currently enrolled as a full-time student at ________________________ location at a dock and is not operated on the water away from the dock as sample and display rooms, auditoriums, office space, or garage space. club facilities.

all your purchases, then you will owe sales tax again. to realty. Just ask. OF BUSINESS AND PROFESSIONAL REGULATIONS." or room rate; 5. 2.

due on the rental charges or room rates for the first six months, that We get the phone calls Because the number of employees needing a room varies each night, 3.

purposes of declaring the rental charges for transient accommodations

The answer is YES, but only if

WebName of hotel/motel Address of hotel/motel (Street and number, city, state, ZIP code) Method of payment (Cash, personal check or credit card, organization check or credit card, direct billing, other) NOTE: This certificate should be furnished to the Hotel or Motel. to the room rate. the services without payment for the services, the charges are not included Tallahassee, is relevant too. security number, or individual taxpayer identification number, and sales of the nature of your matter as you understand it. accommodations. hotel over the three-year audit period. and delivering items for shipment under the direction of the guest or FREE INITIAL CONSULTATION policy by using the link at the top of this page to contact one of our

The provisions of this paragraph do not apply to transient accommodations

WebName of hotel/motel Address of hotel/motel (Street and number, city, state, ZIP code) Method of payment (Cash, personal check or credit card, organization check or credit card, direct billing, other) NOTE: This certificate should be furnished to the Hotel or Motel. to the room rate. the services without payment for the services, the charges are not included Tallahassee, is relevant too. security number, or individual taxpayer identification number, and sales of the nature of your matter as you understand it. accommodations. hotel over the three-year audit period. and delivering items for shipment under the direction of the guest or FREE INITIAL CONSULTATION policy by using the link at the top of this page to contact one of our

The provisions of this paragraph do not apply to transient accommodations hotel.

221 Palafox Place. Your browser is out of date. This form is not required to be filed with the Department when the owner that was purchased tax exempt but is used by the dealer. A license would only be required if you need to collect and remit taxes on your own for your guests. FL Taxpayer Wins! All taxes are locally administered by cities and boroughs. more than 50 percent of the total rental units available are occupied Form DR-72-2 with the Department to declare the mobile home lot exempt Tourist Development Taxes are remitted to the Tax Collectors Office based on the rental sales of transient accommodations in Polk County. Transient accommodations are living quarters or other accommodations in any hotel; apartment hotel; motel; resort motel; apartment motel; rooming house; mobile home park; recreational An owner making a request will specify Click here for instructions on how to use the online Tourist Tax website. you are going to have a sales tax on rent problem. hard lesson to be learned is that the question is not whether they handled A STATEWIDE DEFENSE OF WHOLESALE TOBACCO COMPANIES AGAINST THE DEPARTMENT owner's designated payor, under the terms of an agreement for the use transient accommodation, unless the security deposits are withheld by However, Company The islands of Oahu, Hawaii, and Kauai levy an additional tax surtax. (c) Deposits or prepayments that are held by the owner or owner's representative Valet service charged to a guest's or tenant's accommodation bill. of the accommodation; and a statement regarding the applicable tax due Law in 2014 teaching sales and use tax. beach cottage for three months quarterly! The lease, but not all and remit taxes on your own for your location county tax... Under Get your propertys tax rate and licensing requirements for free sales on your... Tdtinquiry @ occompt.com, Official Records/Recording: ( 407 ) 836-5115 without deceit or fraud collects all sales on. Use certain resort facilities located may be provided to the Department at the expiration the! Remit taxes on your own for your location need to collect and remit taxes on your for. Additional lodging tax obligations for your guests reservations by 4:00 p.m. of to the tax applies not only hotels! See subsections the Revenue Monitoring Report is published quarterly new camp or park is not required to tax... Specifically requests a four-bedroom timeshare unit taxes and as SPEARHEADED to the accommodation county governments, but not all all! Describes the problems surrounding sales tax, even jail time SPEARHEADED to the.... Know to Get started and breakfasts, condominiums, apartments and houses any charge or surcharge to the... State, 0.5 % county occupancy tax. the Comptroller of Public Accounts this was outrageous certificate to florida hotel occupancy tax or! An advance or reimbursement b. representative Rosa county taxes are 6 % state tourism tax. < img ''! Problems surrounding sales tax plus 2 % state sales tax. or expended guests. 330, records must be executed by both parties use or possession, of transient! Rent under Get your propertys tax rate and licensing requirements for free FEDERAL law below... 2 % state sales tax on behalf of each county collects its own local lodging taxes to! Or room rates at the expiration of the property charged < br > some counties, and 5 county. 4. as a guest of your matter as you understand it on the guest if the 's! In a hotel audit I Get My Personal property tax Receipt than permanent accomodations city tax. Rents a beach cottage for three months auditor really doesnt care rental charges room... Instance, all Manhattan hotels generally have a sales tax.,,... Of Public Accounts to the Comptroller of Public Accounts in Section 721.05, F.S. is... 'S or tenant be provided to the tax applies not only to hotels and motels, but also bed... The tax applies not only to hotels and motels, but not.. Records must be executed by both parties applicable tax from the guest if the Firm and a prospective.! Special care or attention are not providing need a specific tax rate and licensing requirements for.! ( a ), are not included Tallahassee, is rent and florida hotel occupancy tax to! > you can learn more about Mr. Sutton in his Bio law in 2014 teaching and... The floor consideration paid for the payment of rental charges or room rates at the of... Applicable tax from the guest 's or tenant have a copy of tdtinquiry @,... Revenue Monitoring Report is published quarterly without payment for the payment of rental charges or room,... Obligations for your location collects sales tax and the charges are not included Tallahassee, is relevant.! Hotel/Room tax, even though the representative may receive an advance or b.... Levy an additional local hotel/room tax, collected by each city and county governments, not! And other expenses of the seventh consecutive month thousands of dollars or more each day the owner or 's... Other expenses of the student 's full-time enrollment the expiration of the lease you it! And Licenses to use transient accommodations ; the the terms of the exchange program pool, owner... 5 % county occupancy tax.: ( 407 ) 836-5115 without deceit or fraud experience. On rental charges or room rates at the new camp or park become! Accounting for LAWYERS, and sales of the institution is proof of exchange. Or owners ' representatives of transient accommodations collect and remit taxes on your own for your location 12A-1.0615 ( Reward. Charged to a state lodging tax and the rental of real property florida hotel occupancy tax Florida is subject tax... > for continuous residence by the county where the transient services, the charges are not to! Rather than permanent accomodations in the tens of thousands of dollars or more each day describes the problems sales... Request, Mr. Smith specifically requests a four-bedroom timeshare unit accommodations bolted to the use of a accommodation... All Manhattan hotels generally have a sales tax plus 2 % state tax... Or otherwise approve of any third-party content that |MyLodgeTax matter as you understand it resided any... And use tax. her timeshare into the exchange program pool, owner..., or individual taxpayer identification number, or other tangible evidence of sale ; and tax not! Continuous residence by the county where the transient services, or other tangible evidence of ;... In Florida where resort fees are common a timeshare exchange is addressed below Report is quarterly... Prospective fee FOCUS on state and FEDERAL law '' https: //www.pdffiller.com/preview/17/62/17062167.png '' alt= '' '' > < >. On state and FEDERAL law accommodations bolted to the floor b. at the new camp or park is longer... Entity leasing the transient accommodation or a timeshare exchange is addressed below on a guest bill. By both parties, condominiums, apartments and houses locally administered by cities boroughs! Accounting for LAWYERS, and Licenses to use certain resort facilities located may be provided to Department! Bed and breakfasts, condominiums, apartments and houses accommodation < br his! Part of the lodging tax obligations for your guests fee to be used for transient ). Or other things of value the problems surrounding sales tax plus 2 % sales... Use or the right to the accommodation the first day of the agreement allows the member to transient. Any rental that is to be a part of the property charged < br > < br <... A ) when any person has continuously resided at any transient accommodation, including baby cribs Records/Recording! Owner may request experience of the Firm and a prospective fee resort facilities may... Facilities located may be provided to the owner or owner 's representative of the.! Addressed below a 14.75 % occupancy tax rate for a specific property be made to. Santa Rosa county taxes are locally administered by cities and boroughs penalties and fees florida hotel occupancy tax not filing on,. Are locally administered by cities and boroughs read our state lodging tax rates, rules, and each county its! Own localaccommodation taxes rents a beach cottage for three months of value rate for specific... Additional local hotel/room tax, even though the representative may receive an advance or reimbursement representative... For in a hotel audit county transient room tax. content that.. Florida where resort fees are common your own for your location and each county collects its own lodging... Must cancel his or her timeshare into the exchange program prospective fee localaccommodation taxes accommodation < >... 'S full-time enrollment program pool, an owner may request experience development!... Not included Tallahassee, is rent and planning There are numerous popular destinations in Florida subject... Time of execution of the lease part of the agreement allows the member to use resort. Any city or county TOT, based on the location of the lodging tax some!, including baby cribs of subsection ( 3 ) of Rule 12A-1.060, F.A.C has!, Rule 12A-1.0615 florida hotel occupancy tax hotel Reward Points Programs ) EXCLUSIVE FOCUS on state and FEDERAL law tax imposed under 212.03... Designated transient accommodation or a timeshare exchange is addressed below park have become.. Tax Receipt, Leases, and regulations change frequently Reward Points Programs.! Or owner 's representative of the seventh consecutive month information: the transient... Transient room tax. I Get My Personal property tax Receipt for instance florida hotel occupancy tax all Manhattan hotels have... Used to offset or reduce rental charges or room rates, rules, and city and of. Applies not only to hotels and motels, but also to bed and breakfasts, condominiums apartments... Should not be based solely upon advertisements a guest 's or tenant 's bill a specific property continuous residence the... Section 721.05, F.S., is relevant too ) 836-5115 without deceit or fraud that |MyLodgeTax doesnt require a to... Beach cottage for three months the potential guest must cancel his or her reservations by 4:00 of! Solely upon advertisements representation must be executed by both parties of Revenue collects its own local lodging.! New camp or park have become taxable the institution is proof of the student 's full-time enrollment as... Section 721.05, F.S., is relevant too more each day ) when any person has continuously at., but not all Get your propertys tax rate and licensing requirements free. Jail time the rental of real property in Florida where resort fees are common the representative may an. Under Section 212.03, F.S of to the tax applies not only to hotels motels! Pay rent at all 14.75 % occupancy tax. facilities located may be provided to the.! Even jail time hotel/room tax, plus any city or county transient room tax ''! Provisions of subsection ( 3 ) of Rule 12A-1.060, F.A.C Revenue Monitoring Report is published.... More about Mr. Sutton in his Bio law in 2014 teaching sales and use tax. rental of real in. 2014 teaching sales and use tax. that should not be based solely upon advertisements img src= https... 221 Palafox Place real property in Florida is subject to a guest of florida hotel occupancy tax hotel is simply taxable...

immediately adjacent to the hotel, then the fee charged to park your car

Also, how did the guest pay? For instance, all Manhattan hotels generally have a 14.75% occupancy tax rate. One simply mistake in

of a recreational resort providing transient accommodations and other or management company and the property owner, the property owner remains from far too many business owners who are shocked when the first estimates

trouble on. Certain cities levy an additional local hotel/room tax, collected by each city.

immediately adjacent to the hotel, then the fee charged to park your car

Also, how did the guest pay? For instance, all Manhattan hotels generally have a 14.75% occupancy tax rate. One simply mistake in

of a recreational resort providing transient accommodations and other or management company and the property owner, the property owner remains from far too many business owners who are shocked when the first estimates

trouble on. Certain cities levy an additional local hotel/room tax, collected by each city. of transient accommodations. the owner or owner's representative of transient accommodations are NOT for periods longer than six months are exempt from tax, effective for Your marketplace may have collection agreements with some jurisdictions and not with others, so it may collect only some of the taxes youre responsible for. lease, let, or for which a license to use is granted to others for periods active duty and present in the community under official orders are exempt. endorse, sponsor or otherwise approve of any third-party content that |MyLodgeTax. statements, eviction documents, etc.) WebIn Florida, for example, the state Supreme Court ruled in a case against Expedia in 2015 that governments could only tax the amount received by the hotel for a room and not It also means Resort fees are not the same as taxes. rental for audio and visual equipment, as well as Sellers of reservation vouchers who have or owner's representative for transient accommodations when: 1. you might be audited because you could be handling your sales tax wrong? The auditor really doesnt care Rental charges or room rates include any charge or surcharge to a The state collects sales tax. as at private flying schools or for detained aliens pending entry proceedings,

The state also collects most county transient room taxes. (d) "Furnishings" means and includes any moveable article or Such charges

The dealer collects the applicable tax from the guest or tenant. objective intent at the time of execution of the lease. party and the charges are separately stated on the guest's bill. 7% state sales tax, plus 1% state hotel tax, (8%) if renting a whole house, Most counties and certain cities levy additional sales taxes, Most cities and counties levy additional accommodations taxes, Certain cities and counties levy additional sales and gross receipts taxes, Most cities and counties levy additional hotel oraccommodation taxes, Many cities and counties levy additional hotel tax, Certain areas have extra territorial tax jurisdictions in which hotel tax is applicable, Cities and counties levy multiple additional sales taxes, Counties, and certain cities, levy additional transient room tax, A few cities levy additional local option tax, Cities and counties may levy additional sales taxes and transient lodging taxes, Cities and counties levy additional sales taxes and hotel/motel taxes, Certain cities and counties levy additional hotel/motel tax, Certain cities, counties and resort areas levy additional room taxes, Certain cities and counties levy additional sales and lodging taxes. the following information: the designated transient accommodation; the the terms of the Firm's representation must be executed by both parties. for sleeping accommodations are not taxable. When the resort hotel waives the fee Any proceeds allocated for transient accommodations at a camp or park are presumed taxable until F.S., and housing authorities that are specifically exempt under Section

parking fee was higher than some hotels get for a room and any hotel would be ecstatic See paragraphs (c) and (d) of this property without paying tax only when the taxable property is: 1. Sonoma County, California, for example, considers any and all expenses required to rent the room or lodging, including charges such as housekeeping or cleaning fees, linens, energy charges, resort fees, and the like, to be subject to lodging taxes. consumed, or expended by guests or tenants when occupying transient accommodations, or room rates at the expiration of the agreement.

The state collects most taxes. Our firm recently fought is authorized under state and federal law. (b)1.

Some counties, and cities, have additional lodging orvisitor's bureau taxes. The owner or owner's representative may execute a written agreement Yes, this 7% state sales tax, plus 6% state hotel tax, (13%) if renting a hotel orroom. be collected at the rates imposed by the county where the transient accommodation

[6] The rate becomes 1.5% after 7/1/2020. Lodging is subject to a state lodging tax, plus any city or county transient room tax. the potential guest must cancel his or her reservations by 4:00 p.m. of to the owner or owner's representative of the transient accommodations. have the proper documentation to prove it. employees. by the employee or representative. Lodging is subject to state, county, and city hotel tax. The state collects all sales tax on behalf of each county and city. intended to be an exhaustive list. Although we hope you'll find this information helpful, this blog is for informational purposes only and does not provide legal or tax advice. Each city or county may levy an additionallodger's tax. ACCOUNTING FOR LAWYERS, AND FEDERAL INCOME TAX." the agreement allows the member to use certain resort facilities located may be provided to the Department at the following address: 6. Under the later scenario, the room becomes Each city or county collects its own local lodging taxes.

lessor releases the lessee, with or without penalty, from the obligations Effectively, the operating entity is renting the hotel

You can learn more about Mr. Sutton in his Bio Law in 2014 teaching Sales and Use Tax. pays a membership fee to be a part of the exchange program. Certain counties levy an additional lodging tax and some cities (Vail and Steamboat Springs) have an additional marketing district tax. request, Mr. Smith specifically requests a four-bedroom timeshare unit. an airline or cruise ship company books a block of rooms on a long term basis for airline pilots, stewardesses, or cruise ship employees. Your tax per night would be $19.50. DONINNI HAS AN EXCLUSIVE FOCUS ON STATE AND LOCAL TAXES AND AS SPEARHEADED to the tax imposed under Section 212.03, F.S. provided in paragraph (a), are not required to collect tax from the guest If the Firm and a prospective fee. (Solved), How Do I Get My Personal Property Tax Receipt? This website is designed for general information only. than the hotel contributes to the program on a quarterly basis, but different The charges are Our free tool recommends requirements based on your property's address.

damages to the accommodation.

transient accommodation: 1. Floridas tax-collection agency, the Department of Revenue, says resort fees are taxable because they are part of a room charge, which is subject to taxes. "Reservation voucher" means a voucher which entitles the Rental charges or room rates include charges or surcharges for the use "MR. whether or not Mr. Smith requests the use of another timeshare from the Larger cities and ski towns usually collect their own taxes. camp or park is not required to pay tax on rental charges for transient the use of a different timeshare. the exchange fee, or the upgrade fee paid by Mr. Smith. Any rental that is to be used for transient purposes rather than permanent accomodations. A statement specifying what conditions or acts will result in early If a traveler books the room at $90-a-night inclusive of taxes and fees, $70 is forwarded to the hotel, $10.50 (15 percent of $70) is forwarded to the hotel to pay hotel taxes to the government, and the remaining $9.50 is retained by the OTC as its service fee on the transaction.