Its an essential component of the way companies are quite rightly pushing cash management right up their operational agenda. Before depositing cash into a UK bank account, you should know that the FCA does not impose a specific limit on cash transactions. Or Respect.

If you are transacting with an overseas contact, there are charges relating to international payments. Registered Office: The Mound, Edinburgh EH1 1YZ. WebA gifted deposit is a cash gift you use to pay for some or all of a mortgage deposit.

If you are transacting with an overseas contact, there are charges relating to international payments. Registered Office: The Mound, Edinburgh EH1 1YZ. WebA gifted deposit is a cash gift you use to pay for some or all of a mortgage deposit.

These are some ways you can deposit money into your bank account. Fee-free transfers from your foreign currency account to a Barclays sterling account in the same name; Fee-free international transfers made via online banking (transfers made via branch or telephone banking cost 25.00); You must have a Barclays sterling current account to be eligible (not including basic accounts); Accounts can be opened in branch or by phone. Online transfers: When you transfer less than 5,000, you pay 10 in fees. Here are some of the cash solutions that have been announced or put in place since our campaign began: First announced in the Queens Speech last May, the forthcoming legislation will ensure people can continue to conveniently withdraw and deposit cash. 10399850. Language links are at the top of the page across from the title. A former journalist, he strives to bring complex information to life in a way that can be widely understood and appreciated.

Instant access to your savings. A Santander spokesperson told Which?

[31] According to Banks, Interscope is trying to get him back due to the success of the single "Beamer, Benz, or Bentley",[32] but failed when Lloyd Banks revealed that he had signed a deal with EMI. This is because even though the Bank of England raises the bank rate to influence other interest rates, large retail banks get to choose when they feed these rate changes on to savers and borrowers. If you have a large sum of money to deposit, you shouldnt deposit too much at once to avoid suspicion.

Those who are looking to save when sending money back to the US; Those who do not yet have proof of residence in the UK; Those who are comfortable managing their finances via an app or online only. It wasn't like an award show when you got some big fat guys in suits on the podium that never even heard my album giving me a rating or judging what I deserve that's actually my most proudest trophy right now. The album was leaked to the internet after Banks had a mnage trois encounter with two women and left the CD album behind. Web1. Non-customers will need a printed paying-in slip from the recipient's account. [17], The album was a commercial success, receiving positive reviews. Just insert your debit card at the counter, confirm the amount and the cash will instantly appear in your account.

Updated daily Compare Compare more instant and easy access accounts up to 5.12% Cash ISAs Table: sorted by interest rate Lloyds Bank's best cash ISA rate of 3.95% is very slightly lower than today's market-best rate of 4.25% . Transfers between two personal Lloyds Bank accounts are made right away.

Elsewhere, Chip still has the top interest rate for an instant access account at 3.4 percent.. It's refreshing to see the EMI staff excited about my project, they have the passion and energy I haven't seen in while. Depositing up to 5,000 per transaction, however, shouldnt raise suspicion or entice a bank to conduct additional queries. This means your daily interest calculation will also slowly increase. All major currencies available. You might find it bizarre that banks would have a problem with someone paying money into your account - but the move is part of the banks' larger obligation duty to combat financial crimes, such as money laundering. Different Post Office branches may have their own maximum deposit amount. Simply log in to Internet Banking or the mobile app and follow the payment instructions. You can still choose to open a USD bank account with a high street bank if you want branch access, but you also have the option of applying online with a digital-only bank instead. Read more: You can pay in both notes and coins at a Post Office counter. Nationwide and Santander both say they advertised the changes to their policies in branches so that customers had advance notice.

This is the amount banks pay out in interest (to savers, for example) versus the amount they make in interest from lending.

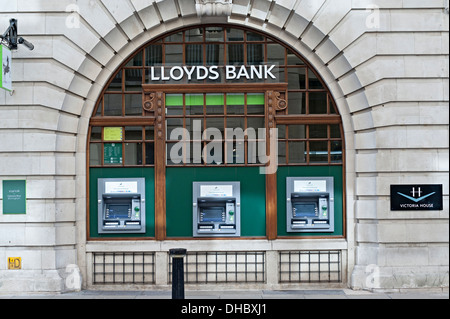

Our TravelMoneyMax tool compares 30+ bureaux to max your holiday cash. Much like the energy companies that have experienced huge increases in profits as gas and electricity prices soared over the past year, the same is now happening at the UKs large retail banks as Bank of England interest rates have done the same. Both need an employer or the bill payer to pay into an account using a sort code and account number. Lloyds Banking Group is shutting 26 Lloyds, nine Halifax and four Bank of Scotland sites. Banks did not go for it and put his third album out under G-Unit Records.[28].

Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first. This will be monitored and enforced Retail banks also earn interest on the billions they hold in reserves with the Bank of England this income has of course increased recently as the central bank has hiked its main rate. Once there, simply follow These days, however, things are a little different and banking has become a lot more competitive. You can send money between accounts with Internet or Mobile Banking, and also in branch.

All those things lead up to that hunger for more, because my more isn't everybody else's more. (All Or Nothing) Series Vol. Customers of Nationwide have been subject to the ban on third-party credits since 12 March 2018, while Santander closed this option just last month. Lloyds Banking Group has announced a further 39 branch closures, on top of the 59 it's already revealed this year - meaning it will close at least 98 sites in 2023. access to cash to be protected by new law, six things you need to know about the new bill to protect cash access and scam victims, Which?

Log on. Loans make up 70% or more of total assets at some high street banks. Registered in England and Wales no.2065. There is some history behind these recent profits. It also offers a foreign currency account that can be opened in US dollars (as well as 11 other currencies). Money podcast: rental scams & landlord struggles. WebChristopher Charles Lloyd (born April 30, 1982), better known by his stage name Lloyd Banks, is an American rapper.He began his career as a member of East Coast hip hop

A gifted deposit must be a gift. Webyou deposit 250.00 in the middle of each month you don't withdraw any money or interest. But how much money can you put in the bank at one time in the UK, and how often can you make deposits?

For more detailed information on our Foreign Currency Accounts & Euro Current Account interest rates, please visit ourinterest ratespage. Link opens in a new tab. The album received very positive reviews and Lloyd banks seemed happy with the reception as he spoke about more upcoming music at a concert he held in Sony Hall. The 6.25 percent AER is fixed for 12 months and will be applied to the balance on the anniversary of the account opening.

If you want to earn interest on the account (1.5% AER on the first 4000 of your balance, 3% AER on the next 1000) youll need to pay out at least 2 direct debits each month. Those who are already settled into UK life and have a UK address and a UK bank account; Those who earn a high salary/have considerable savings; Those who dont mind paying monthly account fees. 24 per year (fee taken in two instalments of 12 charged either in March/September or April/October)3, Foreign banknotes paid in or out (i.e. Link opens in a new tab.

Lloyds Group (includes Lloyds Bank, Halifax and Bank of Scotland): 186, NatWest (including Royal Bank of Scotland sites): 83. Group products and services. Yes, it's possible to put US dollars into a UK bank account. WebAs some people have pointed out above, Club customers also get access to the Club Lloyds Monthly Saver which currently pays 6.25% AER interest for the first 12 months, but you can only pay 400/mth into it (making it a worse deal than, say, a 4% AER 1 year fixed savings account, if you have the ~4800 available to deposit on day 1). (excluding items expressed in Sterling or drawn in the UK), Up to 100 5 [21], Due to the leak, Lloyd Banks began work on Rotten Apple. Please note that due to FSCS and FOS eligibility criteria not all business customers will be covered.

As previously noted, spreading out a lump of cash and depositing it in intervals is the best course of action. While we work hard to scout the market for the best deals, we're unable to consider every possible product available to you. Why you should care about bumper bank profits. Please note this service is for Personal Banking customers only. WebUse our online forms to carry out a wide range of tasks, from ordering a new cheque book to ordering a new PIN for your debit card. Youre probably all too familiar with the often outrageous cost of sending money abroad. Which? Monito's experts spend hours researching and testing services so that you don't have to. He would also go on to twitter to tweet things such as "Let's be real..ain't nobody checking for banks anymore" leaving fans wondering if Lloyd banks was done with music. Get a firmer grip on your finances with the expert tips in our Money newsletter it's free weekly. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. The Bank of England has raised interest rates 11 times since December 2021 but, while this may boost bank profits, it is less likely to boost many peoples bank balances. Traditionally, your only option for opening a bank account in the UK was to approach a high street bank. [24] You can deposit as much money as youd like, but we recommend making deposits of up to 1,000 several times a month to avoid red flags.

If the fee is being debited from a related GBP sterling account it will be charged in March and September. Transfers from 5,000 and above attract a 17.50 charge. You will need a specific cheque envelope and a pre-printed paying in slip to do this.

The title of the album was confirmed by 50 Cent as The Hunger for More 2 in an interview with MTV News. The Big Withdrawal was originally intended to be Lloyd Banks' second album. Interest is variable, worked out daily and paid

The title of the album was confirmed by 50 Cent as The Hunger for More 2 in an interview with MTV News. The Big Withdrawal was originally intended to be Lloyd Banks' second album. Interest is variable, worked out daily and paid It is completely free to open. Our comprehensive range of international accounts and services helps make international trading easier.

There are many reasons why you might need a US dollar account while in the United Kingdom. The charge will be taken whether the payment can or cannot be recalled.