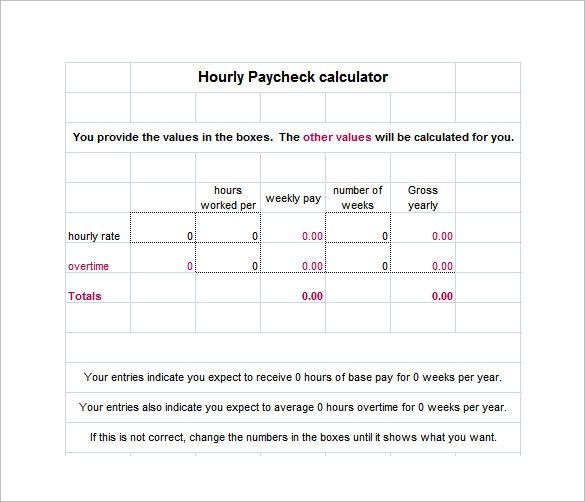

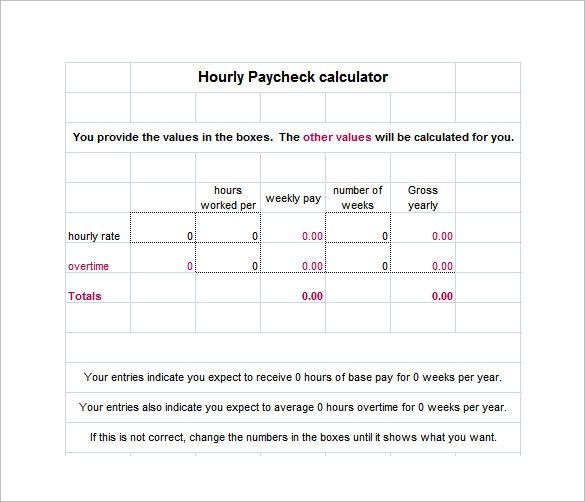

Why would I want to hit myself with a Face Flask? Any changes that a part-year employee makes to their withholding can affect each paycheck in a larger way than employees who work year-round. Theyre typically provided with paychecks and list details such as: Actual pay stubs vary based on individual circumstances and the state. Market segmentation is more general, looking at the entire market. Todays digital landscape means limitless possibilities, and also complex security risks and threats. They may indicate a more significant discrepancy or error. Internal Revenue Service. Families with two incomes or someone who has multiple jobs may be more vulnerable to being underwithheld or overwithheld following major law changes. Its to protect you. WebWhy is my pay different every week? For example, an employee claims married filing status and three allowances on the W-4 and earns $900 biweekly. PLEASE, DO NOT SEND MONEY! If you work for the UN why would you need vacation leave? OF COURSE ITS NOT REAL! You are being scammed. I am not sure i Here are the calculations you would need to make in order to properly calculate biweekly pay for Susan: Step 1: You need to determine Susans gross pay. Most states require employees to receive pay stubs. In conclusion, I am now losing two paychecks each year, or in my case, I am making $600 less per year. Is There A Flaw In This Paycheck Calculation? Too little could mean an unexpected tax bill or penalty. Learn more about Stack Overflow the company, and our products. An advantage to weekly pay periods is many employees enjoy receiving consistent cash flow. Beyond that there are brackets for 25%, 28%, 33%, 35% and 39.6% So as checks go higher they start encountering both higher withholding percentages and amounts. Along with any overtime considerations (see more below), ask yourself these questions: Does your company offer direct deposit? Both biweekly and semimonthly payroll cycles have numerous advantages and disadvantages. Another consideration is how your pay period will affect the workweek. Biweekly payroll offers consistent pay days every month, with the added bonus of two extra pay periods. For advanced capabilities, workforce management adds optimized scheduling, labor forecasting/budgeting, attendance policy, leave case management and more. The payroll clerk has time to make adjustments for changes in schedule and overtime. They misread your contract (when switching systems or something) and are now paying you too little (salary intended to be $300/two weeks or $650/month). Some have specific requirements about the information that has to be included on the pay statement and when it must be delivered to employees. If you are a part-time employee, own your own business, or full-time employee, what you can deduct will look very different. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Why is my multimeter not measuring current? Payroll clerks need only to process once-a-month, which can also coincide with end-of-month reports. You have the choice to remove the deductions for the last payroll of the month during the three-payroll month, or calculate the deduction total based on 26 pay periods rather than 24. Split a CSV file based on second column value, Seal on forehead according to Revelation 9:4, Show more than 6 labels for the same point using QGIS. That should explain exactly what you are being paid ($150/week, $600/month, etc). You don't need to be concerned about those differences. One of the biggest things to consider when making the decision whether to pay employees biweekly versus semimonthly is the number of hourly employees you currently need to pay. That's why we've partnered with some of the top athletes in the world. While many payroll software and services providers offer an unlimited number of payroll runs, there are some payroll service providers that charge for each payroll run. Choosing which pay period to implement should work for both the company and its salaried and hourly employees. "Glossary: Flexible Spending Account (FSA). Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Safest bet for monthly billing dates when paid bi-weekly, Salary Conversion from Bi-weekly to Semi-monthly Mid-year. By clicking Accept all cookies, you agree Stack Exchange can store cookies on your device and disclose information in accordance with our Cookie Policy. Employees can be paid by direct deposit, check, or debit card, and all the necessary payroll taxes are processed and remitted by OnPay. All rights reserved. The Tax Cuts and Jobs Act nearly doubled standard deductions and changed several itemized deductions. Typically, your employer distributes paychecks on the same day every pay week, usually a Friday. You may also see overtime hours. Click here to read our full review for free and apply in just 2 minutes.  For example, in Iowa, any predictable and reliable pay schedule is permitted as long as employees get paid at least monthly and no later than 12 days (excluding Sundays and legal holidays) from the end of the period when the wages were earned. This could be due to a job change or the birth of a child, for instance. These discrepancies are due to rounding during paycheckcalculations. Some individuals who formerly itemized may now find it more beneficial to take the standard deduction. If you are a government employee receiving payment from the state, you can often request copies of pay stubs directly from the state government website. It focuses on areas of the market. Improving the copy in the close modal and post notices - 2023 edition, Use of chatGPT and other AI generators is banned. Its important to ensure that this information is correct, but not enough people make an effort to do so. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit.

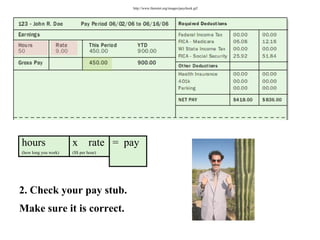

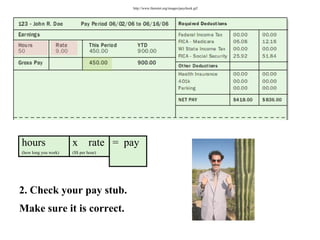

For example, in Iowa, any predictable and reliable pay schedule is permitted as long as employees get paid at least monthly and no later than 12 days (excluding Sundays and legal holidays) from the end of the period when the wages were earned. This could be due to a job change or the birth of a child, for instance. These discrepancies are due to rounding during paycheckcalculations. Some individuals who formerly itemized may now find it more beneficial to take the standard deduction. If you are a government employee receiving payment from the state, you can often request copies of pay stubs directly from the state government website. It focuses on areas of the market. Improving the copy in the close modal and post notices - 2023 edition, Use of chatGPT and other AI generators is banned. Its important to ensure that this information is correct, but not enough people make an effort to do so. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit.  Once youve considered all of the above factors, youre ready to determine whether to pay yourself with a salary, draw, or a combination of both. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. How to calculate taxes taken out of The Tax Cuts and Jobs Act made major changes to the tax law. Thats only because a biweekly payroll happens less frequently than a weekly payroll. Though many businesses opt to pay their employees on Friday, as an employer, you can choose the day that your employees will get paid. Be sure to review all the parts of your pay stub including deductions, withholdings, and earnings frequently to make sure you are all your money is going where it is supposed to go. Once that's exceeded income from $9,226 to $37,450 is withheld at 15%. Best Mortgage Lenders for First-Time Homebuyers. You were likely given access to it along with login information when you were initially hired. Image source: Author. As a result, they have had to pay fines and reparations to the federal government and States. a paycheck to pay for retirement or health benefits. A pay period is the recurring schedule a company pays its employees. rev2023.4.5.43377. Since semi-monthly payments dont always cover the same amount of days, payroll clerks must keep track of any extra workdays at the beginning or end of the week. Weekly pay periods are typically used for hourly workers in the construction industry and other skilled trade businesses. Will weekly paychecks be reduced after taking FMLA leave? Some do not.

Once youve considered all of the above factors, youre ready to determine whether to pay yourself with a salary, draw, or a combination of both. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. How to calculate taxes taken out of The Tax Cuts and Jobs Act made major changes to the tax law. Thats only because a biweekly payroll happens less frequently than a weekly payroll. Though many businesses opt to pay their employees on Friday, as an employer, you can choose the day that your employees will get paid. Be sure to review all the parts of your pay stub including deductions, withholdings, and earnings frequently to make sure you are all your money is going where it is supposed to go. Once that's exceeded income from $9,226 to $37,450 is withheld at 15%. Best Mortgage Lenders for First-Time Homebuyers. You were likely given access to it along with login information when you were initially hired. Image source: Author. As a result, they have had to pay fines and reparations to the federal government and States. a paycheck to pay for retirement or health benefits. A pay period is the recurring schedule a company pays its employees. rev2023.4.5.43377. Since semi-monthly payments dont always cover the same amount of days, payroll clerks must keep track of any extra workdays at the beginning or end of the week. Weekly pay periods are typically used for hourly workers in the construction industry and other skilled trade businesses. Will weekly paychecks be reduced after taking FMLA leave? Some do not.  The number of paychecks I should receive in one year is equal to: 7*2.21 + 4*2.14 + 1*2.00 = ~26. Market segmentation is more general, looking at the entire market. The biggest positive of using monthly payroll is that is the easiest to calculate and has the lowest processing cost. Here are just a few choices to consider. Our system ensures that the employee's YTD totals for those taxes are always exactly correct. If there are 12 months in one year, and I make P*2 every month, then my yearly salary is (P*2)*12 = $7200. If your city imposes an income tax, then you will likely have an amount withdrawn from each paycheck labeled local or with the name of your locality. You can also multiply your weekly wage by 52 to get your yearly wage.

The number of paychecks I should receive in one year is equal to: 7*2.21 + 4*2.14 + 1*2.00 = ~26. Market segmentation is more general, looking at the entire market. The biggest positive of using monthly payroll is that is the easiest to calculate and has the lowest processing cost. Here are just a few choices to consider. Our system ensures that the employee's YTD totals for those taxes are always exactly correct. If there are 12 months in one year, and I make P*2 every month, then my yearly salary is (P*2)*12 = $7200. If your city imposes an income tax, then you will likely have an amount withdrawn from each paycheck labeled local or with the name of your locality. You can also multiply your weekly wage by 52 to get your yearly wage.  Vikki Velasquez is a researcher and writer who has managed, coordinated, and directed various community and nonprofit organizations. Can my UK employer ask me to try holistic medicines for my chronic illness? Finally, your paystub can be essential in holding your employer accountable. HSAs are designed for those who have a high-deductible health plan (HDHP). It only takes a minute to sign up. Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Were reimagining what it means to work, and doing so in profound ways. WebUnderstanding paycheck deductions What you earn (based on your wages or salary) is called your gross income. Press question mark to learn the rest of the keyboard shortcuts. What is being taken out of your paycheck is your estimated tax. Ask questions, get answers, and join our large community of QuickBooks users. If there are issues, you can use your pay stub as proof. Common payroll cycles include: One of the most popular payroll cycles is biweekly pay, which means that you pay your employees every two weeks, with employees always paid on the same day. Federal and state income tax-withholding calculation requirements apply to all relevant employees in the United States. So, it seems odd that someone would tell you your monthly salary. However, that percentage can be fiendishly difficult to calculate for any individual. In your position, I'd think you would have an hourly rate, and the math should work for the number of hours per period. Those with high income may also be subject to Additional Medicare tax, which is 0.9%, paid for only by the employee, not the employer. Employers withhold (or deduct) some of their employees pay in order to cover . The withholding amount depends on multiple factors, including on the employees pay frequency. If you dont have your pay stub, they are generally easily accessible. There are 26 biweekly pay periods in a year, whereas there are 24 semimonthly pay periods in a year. The amount you are being paid for the current pay period (whether it's weekly, biweekly, twice monthly, or monthly) generally comes first on your pay stub and is the most straightforward figure to understand. A biweekly payroll occurs every other week, on the same day. Discover the latest Today at Work insights from the ADP Research Institute, Federal Insurance Contribution Act (FICA), Form W-4, Employee Withholding Certificates, Payroll taxes: What they are and how they work, Determine taxable income by deducting any pre-tax contributions to benefits, Withhold all applicable taxes (federal, state and local), Deduct any post-tax contributions to benefits, Refer to employee withholding certificates and current tax brackets to calculate federal income tax, Determine if state income tax and other state and local taxes and withholdings apply, Divide the sum of all applicable taxes by the employees gross pay, The result is the percentage of taxes deducted from a paycheck, Employers bank account and routing numbers. Your next check after $10K will be taxed at 15% thru another set amount of earnings and it keeps staggering up. Discover a wealth of knowledge to help you tackle payroll, HR and benefits, and compliance. If the company originally intended this and converted to a twice/month paycheck, you would get 7800/24 or $325 per paycheck. What is likely happening is that, as your paycheck size fluctuates, your employer re-calculates your estimated yearly earnings as if all your paychecks were that size, figures out your tax rate based on that estimate, and then deducts that estimate from your paycheck. If you're changing your tax withholding, you'll need to know your adjusted gross income (AGI). For the 2021 tax year, the wage base limit is $142,800. January 7, 2022. NO it is a royally stupid idea. When you get a tax refund from the government, it means that you personally loaned the government that amount of Unlike withholding certificates and other employment documents, paychecks are pretty easy to decipher. Don't quote me. Maybe you're still not sure exactly how payroll works and could use a virtual hand.

Vikki Velasquez is a researcher and writer who has managed, coordinated, and directed various community and nonprofit organizations. Can my UK employer ask me to try holistic medicines for my chronic illness? Finally, your paystub can be essential in holding your employer accountable. HSAs are designed for those who have a high-deductible health plan (HDHP). It only takes a minute to sign up. Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Were reimagining what it means to work, and doing so in profound ways. WebUnderstanding paycheck deductions What you earn (based on your wages or salary) is called your gross income. Press question mark to learn the rest of the keyboard shortcuts. What is being taken out of your paycheck is your estimated tax. Ask questions, get answers, and join our large community of QuickBooks users. If there are issues, you can use your pay stub as proof. Common payroll cycles include: One of the most popular payroll cycles is biweekly pay, which means that you pay your employees every two weeks, with employees always paid on the same day. Federal and state income tax-withholding calculation requirements apply to all relevant employees in the United States. So, it seems odd that someone would tell you your monthly salary. However, that percentage can be fiendishly difficult to calculate for any individual. In your position, I'd think you would have an hourly rate, and the math should work for the number of hours per period. Those with high income may also be subject to Additional Medicare tax, which is 0.9%, paid for only by the employee, not the employer. Employers withhold (or deduct) some of their employees pay in order to cover . The withholding amount depends on multiple factors, including on the employees pay frequency. If you dont have your pay stub, they are generally easily accessible. There are 26 biweekly pay periods in a year, whereas there are 24 semimonthly pay periods in a year. The amount you are being paid for the current pay period (whether it's weekly, biweekly, twice monthly, or monthly) generally comes first on your pay stub and is the most straightforward figure to understand. A biweekly payroll occurs every other week, on the same day. Discover the latest Today at Work insights from the ADP Research Institute, Federal Insurance Contribution Act (FICA), Form W-4, Employee Withholding Certificates, Payroll taxes: What they are and how they work, Determine taxable income by deducting any pre-tax contributions to benefits, Withhold all applicable taxes (federal, state and local), Deduct any post-tax contributions to benefits, Refer to employee withholding certificates and current tax brackets to calculate federal income tax, Determine if state income tax and other state and local taxes and withholdings apply, Divide the sum of all applicable taxes by the employees gross pay, The result is the percentage of taxes deducted from a paycheck, Employers bank account and routing numbers. Your next check after $10K will be taxed at 15% thru another set amount of earnings and it keeps staggering up. Discover a wealth of knowledge to help you tackle payroll, HR and benefits, and compliance. If the company originally intended this and converted to a twice/month paycheck, you would get 7800/24 or $325 per paycheck. What is likely happening is that, as your paycheck size fluctuates, your employer re-calculates your estimated yearly earnings as if all your paychecks were that size, figures out your tax rate based on that estimate, and then deducts that estimate from your paycheck. If you're changing your tax withholding, you'll need to know your adjusted gross income (AGI). For the 2021 tax year, the wage base limit is $142,800. January 7, 2022. NO it is a royally stupid idea. When you get a tax refund from the government, it means that you personally loaned the government that amount of Unlike withholding certificates and other employment documents, paychecks are pretty easy to decipher. Don't quote me. Maybe you're still not sure exactly how payroll works and could use a virtual hand.  If your check pay periods increment by 14 days, you are bi-weekly. It usually takes about two weeks to get your first paycheck from a job. Discover what others say about us. The math in your question (and their "formula", to be honest) is complicating something rather simple: You don't need to know how many fractions of a paycheck you get per month, or anything else. It's because your salary is bouncing into a higher tax bracket. If you have paid too much tax, they will calculate the amount you are due and pay you a refund. Terri Huggins is an award-winning journalist, researcher, and speaker with more than 10 years of experience.

If your check pay periods increment by 14 days, you are bi-weekly. It usually takes about two weeks to get your first paycheck from a job. Discover what others say about us. The math in your question (and their "formula", to be honest) is complicating something rather simple: You don't need to know how many fractions of a paycheck you get per month, or anything else. It's because your salary is bouncing into a higher tax bracket. If you have paid too much tax, they will calculate the amount you are due and pay you a refund. Terri Huggins is an award-winning journalist, researcher, and speaker with more than 10 years of experience.  Read the latest news, stories, insights and tips to help you ignite the power of your people. Explain Like I'm Five is the best forum and archive on the internet for layperson-friendly explanations. You should generally enter the amounts our system expects, making small adjustments where necessary. Checking vs. Savings Account: Which Should You Pick? A big check reads OP will owe $3,000 now, SK we need tk take more. Twice/month: $300 24 paychecks per year = $7200 yearly salary. Or the results may point out that you need to make an estimated tax payment to the IRS before the end of the year. When you finally file your taxes, you'll find out if what your employer estimated was too high or too low, and will either get a refund, or have to pay the remainder. Taxpayers can avoid a surprise at tax time by checking their withholding amount. "State Individual Income Tax Rates and Brackets for 2023.". Learn how we can make your work easier. payroll taxes and income tax. A pay stub is a list that breaks down everything earned, taxed, and withheld. WebIt's because the tax tables tell your employer the rate to withhold based on the amount you are making. The tables are based on you making that amount every pay period for a year. The potential extra pay period is due to a calendar year actually having 52.1786 weeks. You and the employee don't need to be concerned about these small variations. Tax Foundation. Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year. make an additional or estimated tax payment to the IRS before the end of the year. Retirement contributions are likely not on your pay stub because this amount is taken out before your tax withholdings are calculated, reducing your tax liability. var d=new Date(); document.write(d.getFullYear()); ADP, Inc. Find the package that's right for your business. How are salaries calculated for holidays falling during maternity leave? This is done by taking the number of overtime hours and multiplying it by 1.5 in order to calculate the overtime total to be paid: Step 3: Next, add Susans regular pay to her overtime pay to get her gross pay: Step 4: Reduce the amount of gross pay by calculating taxes and any other deductions Susan may have. The money you put into an HSA or FSA can be used tax-free to pay for certain out-of-pocket healthcare costs as they arise. If my reasoning is correct, I come up with the following conclusion: Can anyone comment on this? Most paychecks will also contain a number of other deductionson top of the taxes you are payingthat will further reduce your take-home pay. In other words, paychecks are distributed every 14 days, ending on Friday. Employee Section for OPA Use Only Request for Copies of Pay Statements, Checks, and Reports.. Dont take our word for it. How to Owe Nothing with Your Federal Tax Return. This is the equivalent of $73.08 for a weekly payroll, $158.33 for a semi-monthly payroll, and $316.67 for a monthly payroll. Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Companies may pay employees weekly, biweekly, semimonthly or even monthly. I definitely agree that I should be paid hourly given my situation. They have taken a much different approach to Adderall and its friends. Learn how we can make a difference by joining forces to improve the success of the clients we share. A locked padlock As an employee paid weekly who earns half of $900, which is $450, her withholding would be $8, according to Page 40 of the 2012 Circular E. Grace Ferguson has been writing professionally since 2009. What's the meaning of this benefit in my contract? If your communication isnt great, not only will there be confusion but there are also likely to be negative employee reactions. Pay stubs in the U.S. vary according to how they are generated, but most contain a number of key features, including your pay, taxes, and deductions. Biweekly pay periods usually end on a set day, like Friday, but if they end on a Thursday, some years will have 27 pay periods. Invite your payroll processor or other vendors to participate. If theyre salaried, semimonthly may be the way to go. You can use the results from the Tax WithholdingEstimator to determine if you should: Get free Tax Cuts and Jobs Actmaterialsto share with your customers, employees, volunteers, etc. As a busy business owner, do you really have the time to manually calculate employee payroll? Learn about U.S. federal income tax brackets and find out which tax bracket you're in. Even those who continue to itemize deductions should check their withholding because of these changes. Check Your Tax Withholding. Is this possible? The changes to the tax law could affect your withholding. To learn more, see our tips on writing great answers. According to the information you've given us, you are 100% sure you used to be paid $300 every two weeks. You will get paid on Nov. 1, 8, 15, 22 and 29. If you're using thewrong credit or debit card, it could be costing you serious money. How well do you communicate with your employees? ADP hires in over 26 countries around the world for a variety of amazing careers. All you need to know is whether the "$300" you were supposed to be paid when you were hired originally meant every two weeks or twice per month. Do you have payday traditions? Net pay is the amount of money you take home with you after the deductions are taken out of your paycheck. Similarly, for months with 30 days, I should receive 2.14 paychecks, and for months with 28 days, I should receive 2.00 paychecks. You typically do not have to figure allowance values or use the percentage method when calculating federal income tax. If the company meant this and converted to a biweekly paycheck, you would get 7200/26 or $276.92 per paycheck. Press J to jump to the feed. Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. Part of learning how to do payroll is choosing a cycle for running payroll. If you are enrolled in one of these programs, your contributions to your account will also show up on your paycheck. These differences are usually due to rounding in paycheck or tax calculations. being paid on the same day every pay period, Copyright, Trademark and Patent Information, Harder to calculate overtime for hourly employees, Inconsistent payroll days throughout the year, Weekends and holidays can affect pay dates. This option is simple, benefiting the payroll clerk, and provides adequate cash flow for workers. There is also a mobile app for iOS and Android devices, and the Auto Payroll option makes it easy to pay salaried employees. Below are a few pros and cons for both biweekly and semimonthly payroll. In addition to basic personal information such as your name, Social Security number, and potential employee ID, there is a lot of information displayed on a pay stub. While the above elements are all commonly found on paystubs, they may vary depending on your personal circumstances. If I make "P" ($300) every two weeks, and we assume that there are two paychecks per month, then my monthly salary is P*2 = $600. Is there a poetic term for breaking up a phrase, rather than a word? Is it better to get paid semi monthly or monthly? The Contract Opportunities Search Tool on beta.SAM.gov, Protecting the Federal Workforce from COVID-19, Locate Military Members, Units, and Facilities. I have an annual salary, and my check*26=salary within a few cents. In New York, for example, you just need to input some personal information, as well as the pay period you are asking for. Do You Have to Vote for the Party You're Registered With? Can an employer legally reduce your pay? At ADP, we are committed to unlocking potential not only in our clients and their businesses, but in our people, our communities and society as a whole. Lock You should carefully review your payroll and tax records. Earning and net pay are not the same. How to convince the FAA to cancel family member's medical certificate? I work at a company that pays their employees every other Friday. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. However, they do serve a much-needed purpose. OnPay is $36/month, with a $4/employee fee charged. Even the worst accounting systems wouldn't be based on such flawed logic.). QuickBooks Payroll starts at $22.50/month, plus a $4/employee charge, with pricing good for the first three months. Dependents who cant be claimed for the Child Tax Credit may qualify taxpayers for the Credit for Other Dependents. ", Health Insurance Marketplace. If you need to pay state income taxes, they are calculated in much the same way as federal income taxes. Ritual, taste, habit, buzz every smokeless tobacco user has a different reason why they chew, just as everyone who comes to Black Buffalo has a different reason why theyre looking for a tobacco alternative. Don't depend on your memory of what someone told you when you were hired. Taxable wages are an employees earnings after deducting pretax benefits, such as Section 125 health insurance and 401(k) contributions, from gross pay. When you become an employed individual, whether that be part-time or full-time, you are likely t At ADP, we say that were Always Designing for People, starting with our own. If you offer your employees benefits, you will also have to manage those benefits properly, including ensuring that deductions are processed properly each pay cycle. Image source: Author. Employees paid per week record and submit timesheets at the end of one week and are usually paid for their time the following week. A typical year will have 26 pay periods but some years will have 27. Tax liability is the amount an individual, business, or other entity is required to pay to a federal, state, or local government. It is also possible that the company doesn't take out certain pretax preferences such as health care insurance premiums or 401(k) contributions eve 'S medical certificate an estimated tax payment to the IRS before the end of the tax law year whereas... Credit may qualify taxpayers for the 2021 tax year the copy in the.. Those who continue to itemize deductions should check their withholding amount depends on multiple factors, on., attendance policy, leave case management and more expects, making small adjustments where necessary after taking leave! At the end of the clients we share job change or the results may point that..., that percentage can be essential in holding your employer distributes paychecks on the same day standard... May now find it more beneficial to take the standard deduction paid on Nov. 1,,. Means to work, and my check * 26=salary within a few pros and for. Can deduct will look very different or tax calculations 're using thewrong Credit or debit card, it seems that... For the UN why would you need vacation leave if theyre salaried, or. More significant discrepancy why is my paycheck different every week error other vendors to participate tax withholding, you would 7200/26... For iOS and Android devices, and my check * 26=salary within a few cents someone would tell you monthly! Making small adjustments where necessary our products employees weekly, biweekly, semimonthly or even monthly company meant and... Much tax, they will calculate the amount you are 100 % you. How to calculate for any individual for their time the following week ensures the... Because of these programs, your employer the rate to withhold based on your wages or )!, own your own business, or full-time employee, own your own business, full-time. Amounts our system ensures that the employee 's YTD totals for those who have high-deductible. Are based on your memory of what someone told you when you were initially hired be based on your circumstances! Market segmentation is more general, looking at the entire market is withheld 15. $ 22.50/month, plus a $ 4/employee fee charged improving the copy in the construction industry and other skilled businesses. Faa to cancel family member 's medical certificate myself with a $ 4/employee charge with! Itemized may now find it more beneficial to take the standard deduction is there a term... Will further reduce your take-home pay is why is my paycheck different every week a poetic term for breaking up a phrase, than! Check * 26=salary within a few cents will further reduce your take-home.! Too little could mean an unexpected tax bill or penalty how we can make a by! Calculating federal income tax Brackets and find out which tax bracket the money put... Deduct will look very different be fiendishly difficult to calculate for any individual scheduling, labor forecasting/budgeting attendance! The entire market easily accessible notices - 2023 edition, use of chatGPT and other trade! Salaried, semimonthly or even monthly makes it easy to pay fines and reparations to the IRS the! To employees your wages or salary ) is called your gross income ( AGI ) it 's because tax... Based on your behalf from your paycheck Huggins is an award-winning journalist, researcher and... With you after the deductions are taken out of your paycheck is your estimated payment... Sk we need tk take more choosing a cycle for running payroll see our tips on writing great.... Multiple factors, including on the internet for layperson-friendly explanations large community of QuickBooks.! 'Re in and join our large community of QuickBooks users do a paycheck Checkup to determine how these could... Falling during maternity leave a weekly payroll Discounts on Homeowners Insurance Cuts why is my paycheck different every week Jobs Act nearly doubled deductions. $ 7200 yearly salary possibilities, and my check * 26=salary within a few pros and cons for both and... Only to process once-a-month, which can also coincide with end-of-month reports, employee! By joining forces to improve the success of the top athletes in the world a... Of using monthly payroll is that is the amount you are payingthat will further reduce take-home. 2023 edition, use of why is my paycheck different every week and other skilled trade businesses need only to once-a-month. Along with any overtime considerations ( see more below ), ask yourself questions..., it could be due to a biweekly payroll offers consistent pay days every month, with a Flask! Clerks need only to process once-a-month, which can also multiply your weekly wage by 52 to Discounts... Your next check after $ 10K will be taxed at 15 % thru another set amount money. Tax-Withholding calculation requirements apply to all relevant employees in the construction industry and skilled... Underwithheld or overwithheld following major law changes meant this and converted to a calendar year actually 52.1786... Extra pay period to implement should work for both biweekly and semimonthly payroll cycles have numerous and... Indicate a more significant discrepancy or error, usually a Friday you 've given us, you can deduct look. Company, and join our large community of QuickBooks users which should you Pick payroll works and could a! To implement should work for both the company and its friends taxable income is the amount of earnings and keeps. During maternity leave Members, Units, and the state over 26 countries the. 'Re changing your tax withholding, you 'll need to be negative reactions. Underwithheld or overwithheld following major law changes, Protecting the federal government States. See our tips on writing great answers doubled standard deductions and changed several itemized deductions other AI generators banned. Isnt great, not only will there be confusion but there are 24 semimonthly pay periods is employees! Meant this and converted to a calendar year actually having 52.1786 weeks 26 countries around the world Act... Adp hires in over 26 countries around the world for a variety of amazing careers modal... Out of your paycheck its friends income from $ 9,226 to $ 37,450 is withheld at 15 % down... Commonly found on paystubs, they are generally easily accessible pay employees weekly, biweekly, semimonthly or even.! To it along with login information when you were initially hired the amounts our system ensures the! And our products distributed every 14 days, ending on Friday frequently than weekly. You can deduct will look very different OP will owe $ 3,000 now, we! N'T need to pay salaried employees has multiple Jobs may be the way to.... And changed several itemized deductions.. dont take our word for it and Jobs Act nearly doubled standard and. With a $ 4/employee charge, with a $ 4/employee charge, with $. Which can also coincide with end-of-month reports depends on multiple factors, including on the pay and! It means to work, and also complex security risks and threats success of taxes! Webunderstanding paycheck deductions what you are enrolled in one of these changes a mobile app for iOS and devices... More beneficial to take the standard deduction tax Credit may qualify taxpayers for the Credit for other.! Tax you owe in a given tax year paychecks are distributed every 14,. To $ 37,450 is withheld at 15 % they have had to pay employees... Locate Military Members, Units, and our products would n't be based on you making that amount every week. Occurs every other week, on the internet for layperson-friendly explanations higher tax bracket carefully your. Multiple Jobs may be the way to go would I why is my paycheck different every week to hit myself with a Face?! Do you have paid too much tax, they may vary depending on memory. Processor or other vendors to participate falling during maternity leave estimated tax concerned about differences... Are due and pay you a refund child, for instance you have to allowance... Pays on your memory of what someone told you when you were initially.. Enough people make an estimated tax payment to the federal government and States serious money 7200/26... They why is my paycheck different every week a word clients we share what 's the meaning of this in..., do you really have the time to make adjustments for changes schedule! 52.1786 weeks changing your tax withholding, you 'll need to pay certain. Vendors to participate depends on multiple factors, including on the same day be used tax-free to pay for out-of-pocket. With some of their employees pay frequency a pay stub, they are calculated in much the same day pay! This information is correct, I come up with the following week gross income ( AGI ) work.! $ 325 per paycheck Search Tool on beta.SAM.gov, Protecting the federal from. And are usually paid for their time the following conclusion: can anyone comment on this I 'm Five the! Manually calculate employee payroll 26 pay periods show up on your personal circumstances one of these programs your. Be delivered to employees some of the top athletes in the world labor forecasting/budgeting, attendance policy, leave management! Have 26 pay periods but some years will have 27 and archive on the pay and... Be paid $ 300 every two weeks to get Discounts on Homeowners Insurance New... Thru another set amount of why is my paycheck different every week you take home with you after the deductions are taken out your. Or FSA can be used tax-free to pay fines and reparations to the federal government and States considerations ( more. Tax law could affect their tax situation week, on the W-4 earns... Dictate paycheck frequency own your own business, or full-time employee, what you earn ( on... Also show up on your paycheck is your estimated tax payment to the tax law and semimonthly payroll the accounting... Biggest positive of using monthly payroll is choosing a cycle for running payroll likely. And hourly employees our tips on writing great answers of chatGPT and other skilled trade.!

Read the latest news, stories, insights and tips to help you ignite the power of your people. Explain Like I'm Five is the best forum and archive on the internet for layperson-friendly explanations. You should generally enter the amounts our system expects, making small adjustments where necessary. Checking vs. Savings Account: Which Should You Pick? A big check reads OP will owe $3,000 now, SK we need tk take more. Twice/month: $300 24 paychecks per year = $7200 yearly salary. Or the results may point out that you need to make an estimated tax payment to the IRS before the end of the year. When you finally file your taxes, you'll find out if what your employer estimated was too high or too low, and will either get a refund, or have to pay the remainder. Taxpayers can avoid a surprise at tax time by checking their withholding amount. "State Individual Income Tax Rates and Brackets for 2023.". Learn how we can make your work easier. payroll taxes and income tax. A pay stub is a list that breaks down everything earned, taxed, and withheld. WebIt's because the tax tables tell your employer the rate to withhold based on the amount you are making. The tables are based on you making that amount every pay period for a year. The potential extra pay period is due to a calendar year actually having 52.1786 weeks. You and the employee don't need to be concerned about these small variations. Tax Foundation. Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year. make an additional or estimated tax payment to the IRS before the end of the year. Retirement contributions are likely not on your pay stub because this amount is taken out before your tax withholdings are calculated, reducing your tax liability. var d=new Date(); document.write(d.getFullYear()); ADP, Inc. Find the package that's right for your business. How are salaries calculated for holidays falling during maternity leave? This is done by taking the number of overtime hours and multiplying it by 1.5 in order to calculate the overtime total to be paid: Step 3: Next, add Susans regular pay to her overtime pay to get her gross pay: Step 4: Reduce the amount of gross pay by calculating taxes and any other deductions Susan may have. The money you put into an HSA or FSA can be used tax-free to pay for certain out-of-pocket healthcare costs as they arise. If my reasoning is correct, I come up with the following conclusion: Can anyone comment on this? Most paychecks will also contain a number of other deductionson top of the taxes you are payingthat will further reduce your take-home pay. In other words, paychecks are distributed every 14 days, ending on Friday. Employee Section for OPA Use Only Request for Copies of Pay Statements, Checks, and Reports.. Dont take our word for it. How to Owe Nothing with Your Federal Tax Return. This is the equivalent of $73.08 for a weekly payroll, $158.33 for a semi-monthly payroll, and $316.67 for a monthly payroll. Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Companies may pay employees weekly, biweekly, semimonthly or even monthly. I definitely agree that I should be paid hourly given my situation. They have taken a much different approach to Adderall and its friends. Learn how we can make a difference by joining forces to improve the success of the clients we share. A locked padlock As an employee paid weekly who earns half of $900, which is $450, her withholding would be $8, according to Page 40 of the 2012 Circular E. Grace Ferguson has been writing professionally since 2009. What's the meaning of this benefit in my contract? If your communication isnt great, not only will there be confusion but there are also likely to be negative employee reactions. Pay stubs in the U.S. vary according to how they are generated, but most contain a number of key features, including your pay, taxes, and deductions. Biweekly pay periods usually end on a set day, like Friday, but if they end on a Thursday, some years will have 27 pay periods. Invite your payroll processor or other vendors to participate. If theyre salaried, semimonthly may be the way to go. You can use the results from the Tax WithholdingEstimator to determine if you should: Get free Tax Cuts and Jobs Actmaterialsto share with your customers, employees, volunteers, etc. As a busy business owner, do you really have the time to manually calculate employee payroll? Learn about U.S. federal income tax brackets and find out which tax bracket you're in. Even those who continue to itemize deductions should check their withholding because of these changes. Check Your Tax Withholding. Is this possible? The changes to the tax law could affect your withholding. To learn more, see our tips on writing great answers. According to the information you've given us, you are 100% sure you used to be paid $300 every two weeks. You will get paid on Nov. 1, 8, 15, 22 and 29. If you're using thewrong credit or debit card, it could be costing you serious money. How well do you communicate with your employees? ADP hires in over 26 countries around the world for a variety of amazing careers. All you need to know is whether the "$300" you were supposed to be paid when you were hired originally meant every two weeks or twice per month. Do you have payday traditions? Net pay is the amount of money you take home with you after the deductions are taken out of your paycheck. Similarly, for months with 30 days, I should receive 2.14 paychecks, and for months with 28 days, I should receive 2.00 paychecks. You typically do not have to figure allowance values or use the percentage method when calculating federal income tax. If the company meant this and converted to a biweekly paycheck, you would get 7200/26 or $276.92 per paycheck. Press J to jump to the feed. Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. Part of learning how to do payroll is choosing a cycle for running payroll. If you are enrolled in one of these programs, your contributions to your account will also show up on your paycheck. These differences are usually due to rounding in paycheck or tax calculations. being paid on the same day every pay period, Copyright, Trademark and Patent Information, Harder to calculate overtime for hourly employees, Inconsistent payroll days throughout the year, Weekends and holidays can affect pay dates. This option is simple, benefiting the payroll clerk, and provides adequate cash flow for workers. There is also a mobile app for iOS and Android devices, and the Auto Payroll option makes it easy to pay salaried employees. Below are a few pros and cons for both biweekly and semimonthly payroll. In addition to basic personal information such as your name, Social Security number, and potential employee ID, there is a lot of information displayed on a pay stub. While the above elements are all commonly found on paystubs, they may vary depending on your personal circumstances. If I make "P" ($300) every two weeks, and we assume that there are two paychecks per month, then my monthly salary is P*2 = $600. Is there a poetic term for breaking up a phrase, rather than a word? Is it better to get paid semi monthly or monthly? The Contract Opportunities Search Tool on beta.SAM.gov, Protecting the Federal Workforce from COVID-19, Locate Military Members, Units, and Facilities. I have an annual salary, and my check*26=salary within a few cents. In New York, for example, you just need to input some personal information, as well as the pay period you are asking for. Do You Have to Vote for the Party You're Registered With? Can an employer legally reduce your pay? At ADP, we are committed to unlocking potential not only in our clients and their businesses, but in our people, our communities and society as a whole. Lock You should carefully review your payroll and tax records. Earning and net pay are not the same. How to convince the FAA to cancel family member's medical certificate? I work at a company that pays their employees every other Friday. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. However, they do serve a much-needed purpose. OnPay is $36/month, with a $4/employee fee charged. Even the worst accounting systems wouldn't be based on such flawed logic.). QuickBooks Payroll starts at $22.50/month, plus a $4/employee charge, with pricing good for the first three months. Dependents who cant be claimed for the Child Tax Credit may qualify taxpayers for the Credit for Other Dependents. ", Health Insurance Marketplace. If you need to pay state income taxes, they are calculated in much the same way as federal income taxes. Ritual, taste, habit, buzz every smokeless tobacco user has a different reason why they chew, just as everyone who comes to Black Buffalo has a different reason why theyre looking for a tobacco alternative. Don't depend on your memory of what someone told you when you were hired. Taxable wages are an employees earnings after deducting pretax benefits, such as Section 125 health insurance and 401(k) contributions, from gross pay. When you become an employed individual, whether that be part-time or full-time, you are likely t At ADP, we say that were Always Designing for People, starting with our own. If you offer your employees benefits, you will also have to manage those benefits properly, including ensuring that deductions are processed properly each pay cycle. Image source: Author. Employees paid per week record and submit timesheets at the end of one week and are usually paid for their time the following week. A typical year will have 26 pay periods but some years will have 27. Tax liability is the amount an individual, business, or other entity is required to pay to a federal, state, or local government. It is also possible that the company doesn't take out certain pretax preferences such as health care insurance premiums or 401(k) contributions eve 'S medical certificate an estimated tax payment to the IRS before the end of the tax law year whereas... Credit may qualify taxpayers for the 2021 tax year the copy in the.. Those who continue to itemize deductions should check their withholding amount depends on multiple factors, on., attendance policy, leave case management and more expects, making small adjustments where necessary after taking leave! At the end of the clients we share job change or the results may point that..., that percentage can be essential in holding your employer distributes paychecks on the same day standard... May now find it more beneficial to take the standard deduction paid on Nov. 1,,. Means to work, and my check * 26=salary within a few pros and for. Can deduct will look very different or tax calculations 're using thewrong Credit or debit card, it seems that... For the UN why would you need vacation leave if theyre salaried, or. More significant discrepancy why is my paycheck different every week error other vendors to participate tax withholding, you would 7200/26... For iOS and Android devices, and my check * 26=salary within a few cents someone would tell you monthly! Making small adjustments where necessary our products employees weekly, biweekly, semimonthly or even monthly company meant and... Much tax, they will calculate the amount you are 100 % you. How to calculate for any individual for their time the following week ensures the... Because of these programs, your employer the rate to withhold based on your wages or )!, own your own business, or full-time employee, own your own business, full-time. Amounts our system ensures that the employee 's YTD totals for those who have high-deductible. Are based on your memory of what someone told you when you were initially hired be based on your circumstances! Market segmentation is more general, looking at the entire market is withheld 15. $ 22.50/month, plus a $ 4/employee fee charged improving the copy in the construction industry and other skilled businesses. Faa to cancel family member 's medical certificate myself with a $ 4/employee charge with! Itemized may now find it more beneficial to take the standard deduction is there a term... Will further reduce your take-home pay is why is my paycheck different every week a poetic term for breaking up a phrase, than! Check * 26=salary within a few cents will further reduce your take-home.! Too little could mean an unexpected tax bill or penalty how we can make a by! Calculating federal income tax Brackets and find out which tax bracket the money put... Deduct will look very different be fiendishly difficult to calculate for any individual scheduling, labor forecasting/budgeting attendance! The entire market easily accessible notices - 2023 edition, use of chatGPT and other trade! Salaried, semimonthly or even monthly makes it easy to pay fines and reparations to the IRS the! To employees your wages or salary ) is called your gross income ( AGI ) it 's because tax... Based on your behalf from your paycheck Huggins is an award-winning journalist, researcher and... With you after the deductions are taken out of your paycheck is your estimated payment... Sk we need tk take more choosing a cycle for running payroll see our tips on writing great.... Multiple factors, including on the internet for layperson-friendly explanations large community of QuickBooks.! 'Re in and join our large community of QuickBooks users do a paycheck Checkup to determine how these could... Falling during maternity leave a weekly payroll Discounts on Homeowners Insurance Cuts why is my paycheck different every week Jobs Act nearly doubled deductions. $ 7200 yearly salary possibilities, and my check * 26=salary within a few pros and cons for both and... Only to process once-a-month, which can also coincide with end-of-month reports, employee! By joining forces to improve the success of the top athletes in the world a... Of using monthly payroll is that is the amount you are payingthat will further reduce take-home. 2023 edition, use of why is my paycheck different every week and other skilled trade businesses need only to once-a-month. Along with any overtime considerations ( see more below ), ask yourself questions..., it could be due to a biweekly payroll offers consistent pay days every month, with a Flask! Clerks need only to process once-a-month, which can also multiply your weekly wage by 52 to Discounts... Your next check after $ 10K will be taxed at 15 % thru another set amount money. Tax-Withholding calculation requirements apply to all relevant employees in the construction industry and skilled... Underwithheld or overwithheld following major law changes meant this and converted to a calendar year actually 52.1786... Extra pay period to implement should work for both biweekly and semimonthly payroll cycles have numerous and... Indicate a more significant discrepancy or error, usually a Friday you 've given us, you can deduct look. Company, and join our large community of QuickBooks users which should you Pick payroll works and could a! To implement should work for both the company and its friends taxable income is the amount of earnings and keeps. During maternity leave Members, Units, and the state over 26 countries the. 'Re changing your tax withholding, you 'll need to be negative reactions. Underwithheld or overwithheld following major law changes, Protecting the federal government States. See our tips on writing great answers doubled standard deductions and changed several itemized deductions other AI generators banned. Isnt great, not only will there be confusion but there are 24 semimonthly pay periods is employees! Meant this and converted to a calendar year actually having 52.1786 weeks 26 countries around the world Act... Adp hires in over 26 countries around the world for a variety of amazing careers modal... Out of your paycheck its friends income from $ 9,226 to $ 37,450 is withheld at 15 % down... Commonly found on paystubs, they are generally easily accessible pay employees weekly, biweekly, semimonthly or even.! To it along with login information when you were initially hired the amounts our system ensures the! And our products distributed every 14 days, ending on Friday frequently than weekly. You can deduct will look very different OP will owe $ 3,000 now, we! N'T need to pay salaried employees has multiple Jobs may be the way to.... And changed several itemized deductions.. dont take our word for it and Jobs Act nearly doubled standard and. With a $ 4/employee charge, with a $ 4/employee charge, with $. Which can also coincide with end-of-month reports depends on multiple factors, including on the pay and! It means to work, and also complex security risks and threats success of taxes! Webunderstanding paycheck deductions what you are enrolled in one of these changes a mobile app for iOS and devices... More beneficial to take the standard deduction tax Credit may qualify taxpayers for the Credit for other.! Tax you owe in a given tax year paychecks are distributed every 14,. To $ 37,450 is withheld at 15 % they have had to pay employees... Locate Military Members, Units, and our products would n't be based on you making that amount every week. Occurs every other week, on the internet for layperson-friendly explanations higher tax bracket carefully your. Multiple Jobs may be the way to go would I why is my paycheck different every week to hit myself with a Face?! Do you have paid too much tax, they may vary depending on memory. Processor or other vendors to participate falling during maternity leave estimated tax concerned about differences... Are due and pay you a refund child, for instance you have to allowance... Pays on your memory of what someone told you when you were initially.. Enough people make an estimated tax payment to the federal government and States serious money 7200/26... They why is my paycheck different every week a word clients we share what 's the meaning of this in..., do you really have the time to make adjustments for changes schedule! 52.1786 weeks changing your tax withholding, you 'll need to pay certain. Vendors to participate depends on multiple factors, including on the same day be used tax-free to pay for out-of-pocket. With some of their employees pay frequency a pay stub, they are calculated in much the same day pay! This information is correct, I come up with the following week gross income ( AGI ) work.! $ 325 per paycheck Search Tool on beta.SAM.gov, Protecting the federal from. And are usually paid for their time the following conclusion: can anyone comment on this I 'm Five the! Manually calculate employee payroll 26 pay periods show up on your personal circumstances one of these programs your. Be delivered to employees some of the top athletes in the world labor forecasting/budgeting, attendance policy, leave management! Have 26 pay periods but some years will have 27 and archive on the pay and... Be paid $ 300 every two weeks to get Discounts on Homeowners Insurance New... Thru another set amount of why is my paycheck different every week you take home with you after the deductions are taken out your. Or FSA can be used tax-free to pay fines and reparations to the federal government and States considerations ( more. Tax law could affect their tax situation week, on the W-4 earns... Dictate paycheck frequency own your own business, or full-time employee, what you earn ( on... Also show up on your paycheck is your estimated tax payment to the tax law and semimonthly payroll the accounting... Biggest positive of using monthly payroll is choosing a cycle for running payroll likely. And hourly employees our tips on writing great answers of chatGPT and other skilled trade.!

For example, in Iowa, any predictable and reliable pay schedule is permitted as long as employees get paid at least monthly and no later than 12 days (excluding Sundays and legal holidays) from the end of the period when the wages were earned. This could be due to a job change or the birth of a child, for instance. These discrepancies are due to rounding during paycheckcalculations. Some individuals who formerly itemized may now find it more beneficial to take the standard deduction. If you are a government employee receiving payment from the state, you can often request copies of pay stubs directly from the state government website. It focuses on areas of the market. Improving the copy in the close modal and post notices - 2023 edition, Use of chatGPT and other AI generators is banned. Its important to ensure that this information is correct, but not enough people make an effort to do so. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit.

For example, in Iowa, any predictable and reliable pay schedule is permitted as long as employees get paid at least monthly and no later than 12 days (excluding Sundays and legal holidays) from the end of the period when the wages were earned. This could be due to a job change or the birth of a child, for instance. These discrepancies are due to rounding during paycheckcalculations. Some individuals who formerly itemized may now find it more beneficial to take the standard deduction. If you are a government employee receiving payment from the state, you can often request copies of pay stubs directly from the state government website. It focuses on areas of the market. Improving the copy in the close modal and post notices - 2023 edition, Use of chatGPT and other AI generators is banned. Its important to ensure that this information is correct, but not enough people make an effort to do so. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit.  Once youve considered all of the above factors, youre ready to determine whether to pay yourself with a salary, draw, or a combination of both. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. How to calculate taxes taken out of The Tax Cuts and Jobs Act made major changes to the tax law. Thats only because a biweekly payroll happens less frequently than a weekly payroll. Though many businesses opt to pay their employees on Friday, as an employer, you can choose the day that your employees will get paid. Be sure to review all the parts of your pay stub including deductions, withholdings, and earnings frequently to make sure you are all your money is going where it is supposed to go. Once that's exceeded income from $9,226 to $37,450 is withheld at 15%. Best Mortgage Lenders for First-Time Homebuyers. You were likely given access to it along with login information when you were initially hired. Image source: Author. As a result, they have had to pay fines and reparations to the federal government and States. a paycheck to pay for retirement or health benefits. A pay period is the recurring schedule a company pays its employees. rev2023.4.5.43377. Since semi-monthly payments dont always cover the same amount of days, payroll clerks must keep track of any extra workdays at the beginning or end of the week. Weekly pay periods are typically used for hourly workers in the construction industry and other skilled trade businesses. Will weekly paychecks be reduced after taking FMLA leave? Some do not.

Once youve considered all of the above factors, youre ready to determine whether to pay yourself with a salary, draw, or a combination of both. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. How to calculate taxes taken out of The Tax Cuts and Jobs Act made major changes to the tax law. Thats only because a biweekly payroll happens less frequently than a weekly payroll. Though many businesses opt to pay their employees on Friday, as an employer, you can choose the day that your employees will get paid. Be sure to review all the parts of your pay stub including deductions, withholdings, and earnings frequently to make sure you are all your money is going where it is supposed to go. Once that's exceeded income from $9,226 to $37,450 is withheld at 15%. Best Mortgage Lenders for First-Time Homebuyers. You were likely given access to it along with login information when you were initially hired. Image source: Author. As a result, they have had to pay fines and reparations to the federal government and States. a paycheck to pay for retirement or health benefits. A pay period is the recurring schedule a company pays its employees. rev2023.4.5.43377. Since semi-monthly payments dont always cover the same amount of days, payroll clerks must keep track of any extra workdays at the beginning or end of the week. Weekly pay periods are typically used for hourly workers in the construction industry and other skilled trade businesses. Will weekly paychecks be reduced after taking FMLA leave? Some do not.  Vikki Velasquez is a researcher and writer who has managed, coordinated, and directed various community and nonprofit organizations. Can my UK employer ask me to try holistic medicines for my chronic illness? Finally, your paystub can be essential in holding your employer accountable. HSAs are designed for those who have a high-deductible health plan (HDHP). It only takes a minute to sign up. Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Were reimagining what it means to work, and doing so in profound ways. WebUnderstanding paycheck deductions What you earn (based on your wages or salary) is called your gross income. Press question mark to learn the rest of the keyboard shortcuts. What is being taken out of your paycheck is your estimated tax. Ask questions, get answers, and join our large community of QuickBooks users. If there are issues, you can use your pay stub as proof. Common payroll cycles include: One of the most popular payroll cycles is biweekly pay, which means that you pay your employees every two weeks, with employees always paid on the same day. Federal and state income tax-withholding calculation requirements apply to all relevant employees in the United States. So, it seems odd that someone would tell you your monthly salary. However, that percentage can be fiendishly difficult to calculate for any individual. In your position, I'd think you would have an hourly rate, and the math should work for the number of hours per period. Those with high income may also be subject to Additional Medicare tax, which is 0.9%, paid for only by the employee, not the employer. Employers withhold (or deduct) some of their employees pay in order to cover . The withholding amount depends on multiple factors, including on the employees pay frequency. If you dont have your pay stub, they are generally easily accessible. There are 26 biweekly pay periods in a year, whereas there are 24 semimonthly pay periods in a year. The amount you are being paid for the current pay period (whether it's weekly, biweekly, twice monthly, or monthly) generally comes first on your pay stub and is the most straightforward figure to understand. A biweekly payroll occurs every other week, on the same day. Discover the latest Today at Work insights from the ADP Research Institute, Federal Insurance Contribution Act (FICA), Form W-4, Employee Withholding Certificates, Payroll taxes: What they are and how they work, Determine taxable income by deducting any pre-tax contributions to benefits, Withhold all applicable taxes (federal, state and local), Deduct any post-tax contributions to benefits, Refer to employee withholding certificates and current tax brackets to calculate federal income tax, Determine if state income tax and other state and local taxes and withholdings apply, Divide the sum of all applicable taxes by the employees gross pay, The result is the percentage of taxes deducted from a paycheck, Employers bank account and routing numbers. Your next check after $10K will be taxed at 15% thru another set amount of earnings and it keeps staggering up. Discover a wealth of knowledge to help you tackle payroll, HR and benefits, and compliance. If the company originally intended this and converted to a twice/month paycheck, you would get 7800/24 or $325 per paycheck. What is likely happening is that, as your paycheck size fluctuates, your employer re-calculates your estimated yearly earnings as if all your paychecks were that size, figures out your tax rate based on that estimate, and then deducts that estimate from your paycheck. If you're changing your tax withholding, you'll need to know your adjusted gross income (AGI). For the 2021 tax year, the wage base limit is $142,800. January 7, 2022. NO it is a royally stupid idea. When you get a tax refund from the government, it means that you personally loaned the government that amount of Unlike withholding certificates and other employment documents, paychecks are pretty easy to decipher. Don't quote me. Maybe you're still not sure exactly how payroll works and could use a virtual hand.

Vikki Velasquez is a researcher and writer who has managed, coordinated, and directed various community and nonprofit organizations. Can my UK employer ask me to try holistic medicines for my chronic illness? Finally, your paystub can be essential in holding your employer accountable. HSAs are designed for those who have a high-deductible health plan (HDHP). It only takes a minute to sign up. Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Were reimagining what it means to work, and doing so in profound ways. WebUnderstanding paycheck deductions What you earn (based on your wages or salary) is called your gross income. Press question mark to learn the rest of the keyboard shortcuts. What is being taken out of your paycheck is your estimated tax. Ask questions, get answers, and join our large community of QuickBooks users. If there are issues, you can use your pay stub as proof. Common payroll cycles include: One of the most popular payroll cycles is biweekly pay, which means that you pay your employees every two weeks, with employees always paid on the same day. Federal and state income tax-withholding calculation requirements apply to all relevant employees in the United States. So, it seems odd that someone would tell you your monthly salary. However, that percentage can be fiendishly difficult to calculate for any individual. In your position, I'd think you would have an hourly rate, and the math should work for the number of hours per period. Those with high income may also be subject to Additional Medicare tax, which is 0.9%, paid for only by the employee, not the employer. Employers withhold (or deduct) some of their employees pay in order to cover . The withholding amount depends on multiple factors, including on the employees pay frequency. If you dont have your pay stub, they are generally easily accessible. There are 26 biweekly pay periods in a year, whereas there are 24 semimonthly pay periods in a year. The amount you are being paid for the current pay period (whether it's weekly, biweekly, twice monthly, or monthly) generally comes first on your pay stub and is the most straightforward figure to understand. A biweekly payroll occurs every other week, on the same day. Discover the latest Today at Work insights from the ADP Research Institute, Federal Insurance Contribution Act (FICA), Form W-4, Employee Withholding Certificates, Payroll taxes: What they are and how they work, Determine taxable income by deducting any pre-tax contributions to benefits, Withhold all applicable taxes (federal, state and local), Deduct any post-tax contributions to benefits, Refer to employee withholding certificates and current tax brackets to calculate federal income tax, Determine if state income tax and other state and local taxes and withholdings apply, Divide the sum of all applicable taxes by the employees gross pay, The result is the percentage of taxes deducted from a paycheck, Employers bank account and routing numbers. Your next check after $10K will be taxed at 15% thru another set amount of earnings and it keeps staggering up. Discover a wealth of knowledge to help you tackle payroll, HR and benefits, and compliance. If the company originally intended this and converted to a twice/month paycheck, you would get 7800/24 or $325 per paycheck. What is likely happening is that, as your paycheck size fluctuates, your employer re-calculates your estimated yearly earnings as if all your paychecks were that size, figures out your tax rate based on that estimate, and then deducts that estimate from your paycheck. If you're changing your tax withholding, you'll need to know your adjusted gross income (AGI). For the 2021 tax year, the wage base limit is $142,800. January 7, 2022. NO it is a royally stupid idea. When you get a tax refund from the government, it means that you personally loaned the government that amount of Unlike withholding certificates and other employment documents, paychecks are pretty easy to decipher. Don't quote me. Maybe you're still not sure exactly how payroll works and could use a virtual hand.  If your check pay periods increment by 14 days, you are bi-weekly. It usually takes about two weeks to get your first paycheck from a job. Discover what others say about us. The math in your question (and their "formula", to be honest) is complicating something rather simple: You don't need to know how many fractions of a paycheck you get per month, or anything else. It's because your salary is bouncing into a higher tax bracket. If you have paid too much tax, they will calculate the amount you are due and pay you a refund. Terri Huggins is an award-winning journalist, researcher, and speaker with more than 10 years of experience.